At By The Sea Realty we have always considered inventory to be an important indicator in our local real estate market. We look at inventory levels to project future market activity and we frequently evaluate inventory in our neighborhoods and smaller sub-markets to help with pricing our listings. Recently inventory has been getting a lot more attention as markets across the country have experienced a steep decline in new listings since the beginning of the pandemic. That is no longer the case with our broader local market in Northeast Broward county, but when we break our reports down into sub markets and price ranges we get some very different results.

Northeast Broward County

The primary markets we service from our Fort Lauderdale office are the coastal communities of Northeast Broward County. This area includes Fort Lauderdale, Pompano Beach, Lauderdale-by-the-Sea, Lighthouse Point, Hillsboro Beach, Deerfield Beach, Oakland Park and Wilton Manors. This is a relatively densely populated area with a higher proportion of condominium units than the rest of the country. We will break down our analysis between condos and single family homes, but first lets look at the overall market.

As you can see, we started the year with less inventory than the same time last year, so we were already behind prior to the lockdown in April and May. However, we quickly recovered and inventory levels are now higher than they were at this time last year with August inventory at 3,699 units versus 3,543 units in August 2019.

Looking at closed Sales over the same period we had a dramatic drop in sales during April and May of this year due to the pandemic, but again, we recovered quickly as demonstrated with more sales over the last 2 months than last year. August recorded 567 sales versus only 460 sales in August of 2019. Something to consider is that a portion of the recent uptick in inventory and closings is due to pent up demand, but the fact is that we were already experiencing a very strong market at the start of the year, so the quick recovery should not be a surprise.

Single Family vs. Condominium

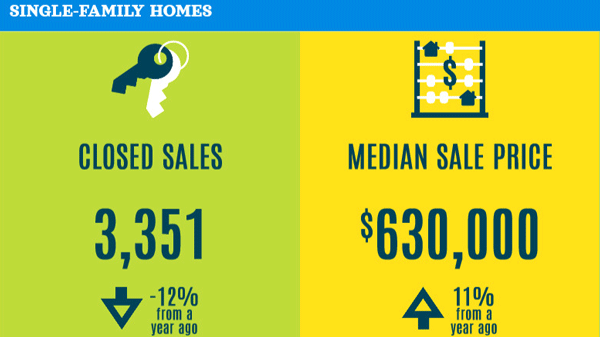

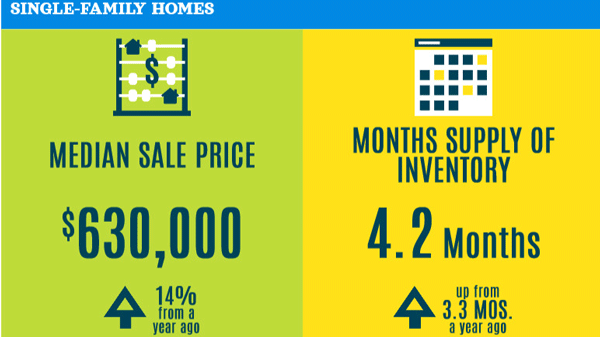

Our real estate market has a larger percentage of condos than most, so we are experiencing some different dynamics in the 2 market segments. Currently single family homes are in higher demand due to COVID-19 which is causing a much larger supply problem in the single family markets, especially for properties listed at $1,000,000 or lower where supply is currently hovering just above 3 months. Condo supply under the median list price of $400,000 is relatively normal considering the circumstances with 6.79 months of supply, whereas condos in the higher price ranges are experiencing excess supply at this time. Fewer sales in the condo markets are due in part to difficulty showing property at some associations as well as the unwillingness of out-of-town buyers to travel to Florida. We expect our condo markets to get back to normal once the pandemic is under control.

It is important to understand that the absorption rates reported below include the months of April and May where sales were down about 50% from the same months last year. While the market has begun to catch up, we believe the true “Months of Inventory” is still lower than reported below. Inventory below 6-7 months is considered a seller’s market whereas inventory above 6-7 months is considered a buyer’s market.

Single Family Homes Up To $1,000,000

When looking at inventory below $1,000,000 it becomes glaringly obvious why this segment currently has the lowest supply. We started the year with significantly less inventory than last year and while inventory has slowly increased to almost normal levels it still cannot keep up with demand. Compared to last year 2020 sales are up 23% in July and 33% in August.

Single Family Homes Over $1,000,000

While this segment appears to have excess inventory and is technically more of a buyer’s market, we can tell you first hand that activity is strong in this segment and as you can see we are experiencing a much higher level of closed sales this summer compared to last summer with August reporting twice as many sales as last year.

Condos and Townhouses Up To $400,000

The below median condo segment is essentially at equilibrium, but in reality true demand is not reflected in the numbers since some condo buildings have showing restrictions and it is more difficult for out of town buyers to travel. We anticipate this segment will tighten even more as the pandemic gets under control, especially since these units are a large percentage of our overall inventory and are historically very popular.

Condos and Townhouses Over $400,000

Technically this segment has more excess inventory than any other segment in our market, but it is still too soon to tell if and when this will correct itself. Pandemic era buyers are looking for more living area, 3 or 4 bedrooms, semi private elevators and smaller buildings with fewer residents. Since these are qualities found mostly in the higher end buildings we are optimistic that demand will soon catch up in this segment, especially if we start to see price reductions as inventory sits through the end of the year.

How is inventory affecting your property value?

While this report provides us with a good overview of the overall market, it does not necessarily speak to your exact property. We provide more precise inventory reports to our customers that reflect their exact markets. Ask us for a custom report today!