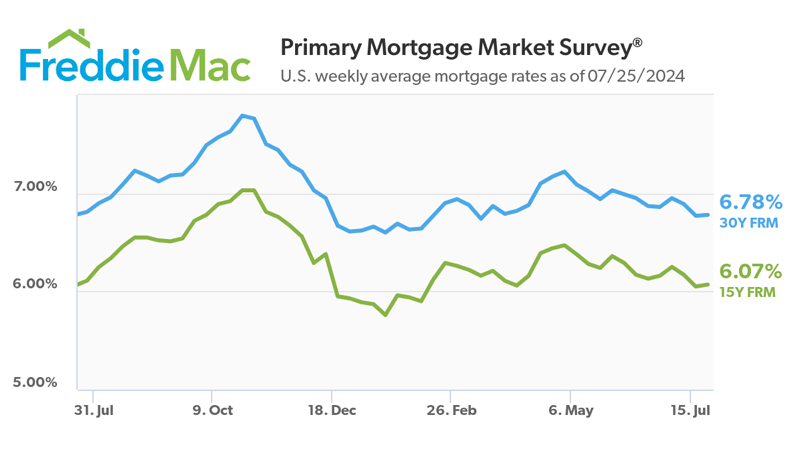

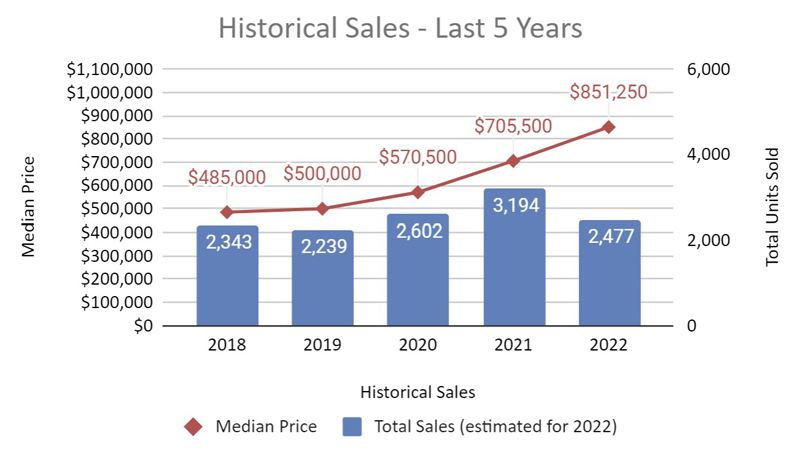

From June 2021 to June 2022 mortgage interest rates have jumped about 2 percent. Historically that is an unusually high increase in rates and is difficult for many buyers to stomach, especially since we’ve been spoiled with historically low rates for a sustained period of time. During that same period of time the median sales price of a home in Northeast Broward County has increased over 20%.

Most experts including myself, do not believe that price appreciation at this level is sustainable. However, no one expects median sales prices to decline either. Why the optimism? Historically, higher mortgage rates have been associated with economic factors like higher inflation, lower unemployment, and stronger wage growth, the same factors that are associated with high home price appreciation. When you factor in the low housing supply and continued demand for housing in South Florida it is hard to imagine median sale prices dropping anytime soon, but double digit increases are hard to imagine as well.

What about affordability?

Yes, affordability is a concern in our market and many buyers have been forced to the sidelines unable to purchase their dream home. The pool of buyers has decreased and should bring some welcome relief to our inventory issues. However, we also have one of the most expensive rental markets in the country with average rents going up more than median sales prices. Even with mortgage rates and median prices going up, it still makes sense for most people to buy a home instead of renting. Buyers are looking at smaller homes and condos as more affordable options and they are also considering adjustable rate mortgages which are still in the low to mid 4’s.

Get a Free Rent vs Buy Analysis

So where are rates and prices going in the next year?

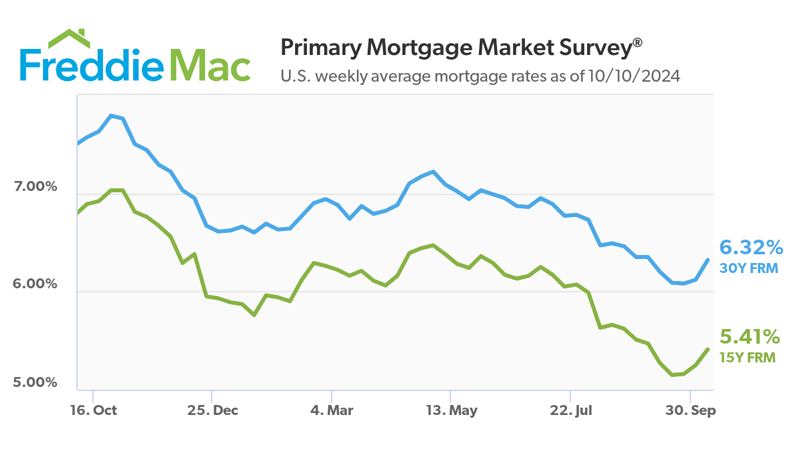

Nobody knows exactly what mortgage rates are going to do, but many experts believe 30 year fixed rates will stay in the 5% to 7% range through the end of 2022. Lawrence Yun, chief economist for the National Association of Realtors said “Mortgage rates bouncing along near 6% is certain for the remainder of the year.” Higher mortgage interest rates may slow down home price appreciation, but its only one of the factors affecting home values.

What happens to median prices in the next year is really more a matter of supply and demand. In northeast Broward county the supply of single family homes is around 3 months of inventory and for condos it is even lower at 2 months. While inventory is ticking up slowly, supply this low is still considered a very strong seller’s market. Yes, the buyer pool is a bit smaller now, but mortgage rates are still historically low, rents are incredibly high and population is rising with overall housing demand still strong. We are certainly not expecting 20% increases in median sales prices again this year, but most experts are targeting price increases in the 5-10% range for the coming year. Just about everyone agrees though that prices are not going down in the near term.