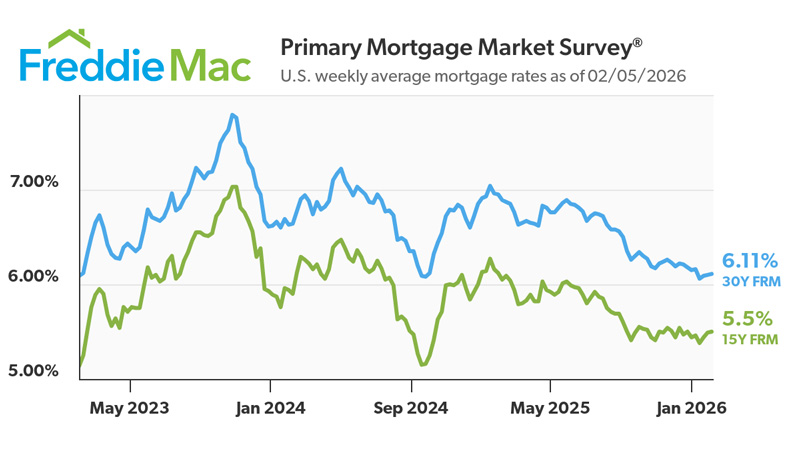

Last month, mortgage rates dropped to their lowest levels in three years. At the same time, rates have entered a period of remarkable stability, hovering just above 6% for several months now. After years of sharp swings, this consistency has given buyers, sellers, and homeowners something they haven’t had in a while: predictability.

30-year fixed rates averaged 6.11% this week, just five basis points higher than their three-year low point from a few weeks ago. Combined with modest real wage growth and relatively flat median sale prices over the past two years, the “affordability” problem is slowly correcting itself. This is a welcome trend as we enter Florida’s busy winter season.

Where do rates go from here? For now, enjoy the stability and don’t expect large rate changes in either direction. The Federal Reserve is only expected to cut its benchmark rate a couple of times in 2026, and those cuts are not expected anytime soon. Even if the Fed does cut rates again this year, don’t expect mortgage rates to fall further, as those cuts are already baked into current pricing.