Inventory Still Limited, Median Prices Still on the Rise

Housing inventory remains in short supply across South Florida with months supply of inventory averaging only 3.3 months for single family homes and 3.8 months for townhomes and condos. That is still a very strong sellers market and with demand still high during our peak winter season there is no relief in sight for buyers facing limited inventory and rising median prices. The median price of a single family home in the region was $552,000, up a modest 4.2% over February last year. Townhomes and condos median prices were up 6.7% over last year to $320,000.

Its hard to say what lies ahead for for South Florida’s real estate market, but our pending sales data indicates that our inventory problems aren’t going away anytime soon. Pending sales are down from last year, but up significantly since December and much closer to normal levels for this time of year. However, interest rates also inched up in February, so perhaps demand will slow down a bit and provide serious buyers with more opportunities to enter the marketplace? Is the South Florida market really heating up again or is this just a normal busy season? That remains to be seen. Stay tuned.

We are still in a very strong sellers market and with demand still high during our peak winter season there is no relief in sight for buyers facing limited inventory and rising median prices.

Broward County

Including the beautiful coastal towns of Fort Lauderdale, Pompano Beach and Lauderdale-by-the-Sea, Broward County single family home sales totaled just 833 sales in February, down about 30% since last year. However, pending sales are up again, so expect we expect single family inventory to remain low. The median sale prices in Broward County was $560,000 which is the highest in South Florida and up almost 8% over last year. The county still has only 2.8 months supply of single family homes, down from last month and still the lowest in South Florida.

Condo and townhome sales in Broward County were back up in February to 1,006 total sales which effectively gobbled up all new inventory. Pending sales were also up for a second consecutive month and with inventory levels at only 3.2 months supply we expect low inventory will continue to favor sellers throughout the winter and spring seasons. Median sale prices for condos and townhomes to increased to $272,000, up 13.3% over last year and another record high for the county.

Palm Beach County

Single family sales in Palm Beach County totaled 975 sales, down over 21% from last year, but a nice recovery from a very slow January. Just like the rest of South Florida, pending sales jumped up in February for the second consecutive month, which should keep inventory levels low. The median sale price however was down to $549,500 which is still way below the peak of $620,000 in June 2022. Single family inventory remains low at 3.3 months supply in Palm Beach County.

Palm Beach County condo and townhome sales recovered slightly in February, but were still down 38% from last year. Median sale prices remained flat month over month, but are still up over 9% from February of last year. Condo and townhome inventory was up again to 3.7 months of supply.

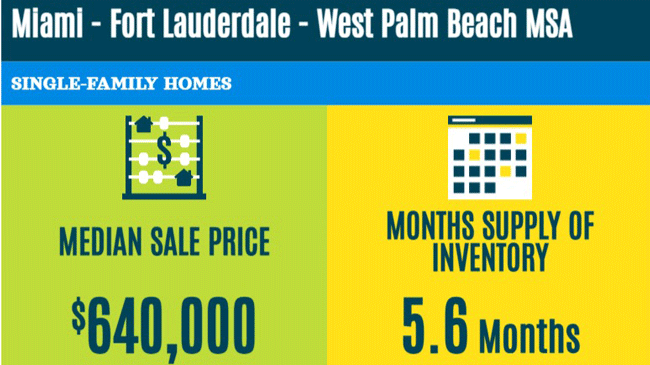

Miami-Dade County

Miami-Dade single family home sales in February were up slightly to 727 total sales, a nice increase over last month’s record low, but still well below average for the county. The median sales price was up a modest 3.5% to $555,000. Months supply of single family homes is still the highest in the tri-county area at 3.8 months, but with pending sales up and new listings down, we expect inventory to remain low.

Like last month, condo and townhome sales in Miami-Dade dropped significantly with just 965 total sales and the median sale price also dropped to $390,000, below the peak of $415,000 last May. Just like the single family market, the condo and townhome inventory was the highest in South Florida at 4.5 months supply in February. With plenty of new construction projects on the horizon we expect Miami-Dade condo supply to continue leading the tri-county area.

Florida’s Population Growth

As we reported last month our local demand is closely tied to Florida’s strong domestic and international migration. According to the National Association of Realtors Florida had the highest net domestic migration gain of any state in the nation with 318,855 people moving to Florida from other states in 2022. When you figure in net international migration, Florida is also the fastest growing state, with an annual population increase of 1.9% in 2022. As long as people keep moving to Florida the demand for housing will continue to be strong, inventory levels will remain low and median sale prices are likely to continue their upward trend.

Florida is the fastest growing state, with an annual population increase of 1.9% in 2022

Summary

After a slow start in January the market is gaining steam again and we are still optimistic about our winter and spring seasons. The question remains whether the current demand is here to stay, or are we just experiencing the start of a normal busy season? One thing is for certain, our markets are performing better than most of the country right now and as long as people keep moving here we can expect that trend to continue.

For a detailed market analysis of your condo or single family home please contact a local agent.