Sales Volume Down, Median Prices Remain at Record Highs

South Florida home sales were down from last year and still well below the average June volume. It seems affordability and higher interest rates are still keeping some buyers on the sidelines. However, median prices remain at or near record highs throughout South Florida.

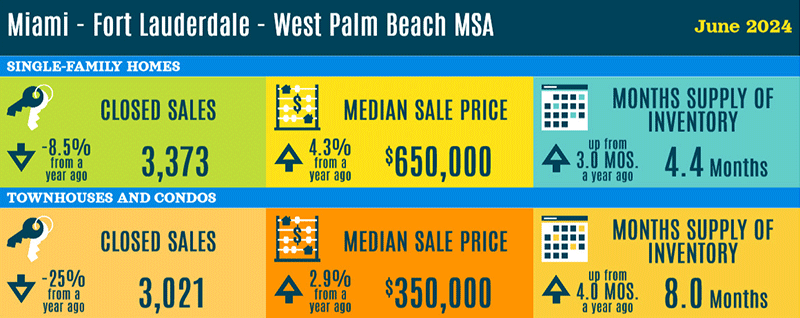

Single family home sales were down 8.5% from June of last year in the tri-county area, but median prices were up to $650,000, matching an all-time high from 2 months ago. Inventory is still the big story for single family homes. Months supply remains low at only 4.4 months of supply. This is still a seller’s market, but slowly approaching equilibrium.

Condo sales were down 25% from last June. Despite this sharp drop in volume, median prices remain high at $350,000. This is only $5,000 below last month’s all-time high. Condo inventory in South Florida is up to normal pre-pandemic levels at 8 months of supply.

We still have a lot of older condo buildings with ongoing renovations and increasing assessments. This makes financing difficult and sometimes impossible. As more buildings catch up with deferred maintenance we expect increased buyer demand for condos. In the meantime, an experienced local agent can help buyers and sellers navigate this challenging condo market.

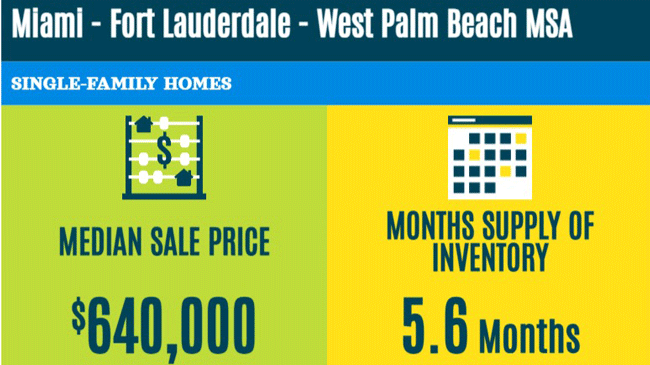

Single Family home sale prices in South Florida reach another all-time high and it is still a seller’s market.

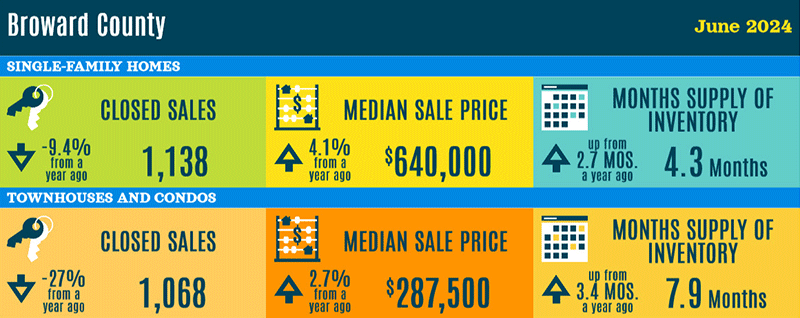

Broward County

The median sale price for a single family home in Broward County is up 4.1% over last year to $640,000. This is an all-time high median sale price for Broward County. Compared to last month, inventory remains flat at 4.3 months of supply. This is a seller’s market and the lowest single family inventory in the tri-county area.

The median price for condos and townhomes in Broward County is up 2.7% from last year to $287,500, despite low sales volume and increasing supply. Condo inventory is up slightly from last month to 7.9 months supply. This is essentially an equilibrium, which is neither a buyer’s or seller’s market.

The single family market in Broward County is still favoring sellers with only 4.3 months of supply.

Broward County, Florida includes the coastal communities of Fort Lauderdale, Pompano Beach, Lauderdale-by-the-Sea, Lighthouse Point, Hillsboro Beach and Deerfield Beach.

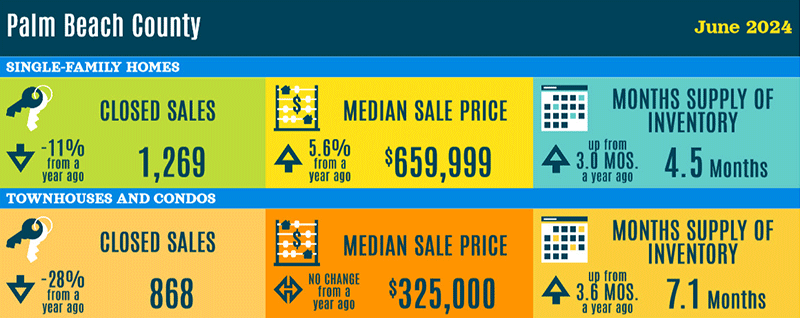

Palm Beach County

The median sale price of a single family home in Palm Beach County was up 5.6% over last year to just under $660,000. This is another all-time high. Single family inventory is up slightly, but remains low at only 4.5 months of supply. This is a seller’s market.

The median sale price of condos and townhomes in Palm Beach County remains unchanged from last year at $325,000. Condo inventory is a bit tighter in Palm Beach County with only 7.1 months of supply.

Condo inventory in Palm Beach County is the lowest in South Florida at 7.1 months of supply, not favoring buyers or sellers.

Palm Beach County, Florida includes the coastal communities of Boca Raton, Delray Beach, Boynton Beach, Lantana, Manalapan, West Palm Beach, Singer Island, North Palm Beach, Juno Beach and Jupiter.

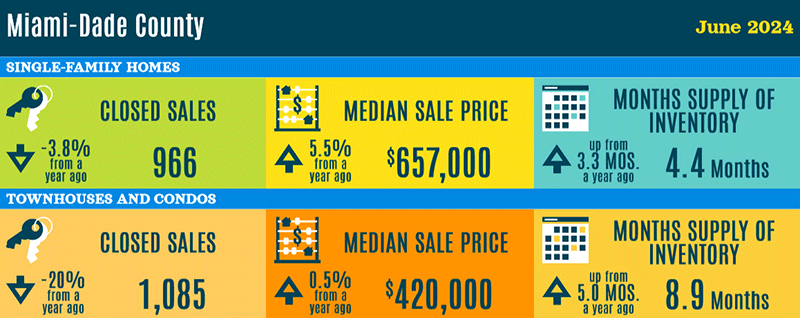

Miami-Dade County

The median sale price of a single family home in Miami Dade County was up 5.5% from last year to $657,000, another all-time high. Inventory has remained flat since January with only 4.4 months of supply. This is still a seller’s market.

The median price for condos and townhomes in Miami Dade County was only slightly up over last year to $420,000, but down from the peak in March of $445,000. Miami has the most condo inventory in the tri-county area with almost 9 months of supply. This is a buyer’s market and it seems to be putting downward pressure on sale prices, at least in the short term.

Condo inventory in Miami/Dade County is the highest in South Florida at 8.9 months of supply. This is a buyer’s market and is putting downward pressure on median sale prices, at least in the short term.

Miami-Dade County includes the coastal communities of Miami, Miami Beach, Sunny Isles Beach, Golden Beach, Bal Harbour, Surfside and Key Biscayne.

Summary

June is typically a busy month for real estate closings, but this year is a bit different, due in part to our changing condo market. Many older buildings are trying to keep up with new regulations regarding inspections and reserve requirements. As more newly renovated buildings come online we should see a return to normal transaction volume. In the meantime, there are plenty of good deals to be had in our condo market.

Single family remains strong throughout South Florida with low supply and steadily increasing median sale prices. Sales volume is still historically low, but that could change quickly if interest rates continue to come down. Serious buyers shouldn’t wait for that to happen. When interest rates come down more buyers will enter the market pushing prices even higher. Now is a good time to buy, but find an agent who specializes in our local market. Their hard work, patience and local knowledge will pay off.

Are you thinking of selling? Every seller situation is different, so its hard to say if now is your best time to sell. For example, if you own a single family home in a tight market and you are considering downsizing to a smaller condo, then now might be a perfect time. Consult with your By The Sea Realty agent to determine your best sell/buy strategy. We utilize a suite of seller tools to help you accomplish your real estate goals. Its starts with our industry leading Cloud CMA.

For a detailed market analysis of your condo or single family home, or for professional assistance with your home search in South Florida please contact one of our local trusted agents.