Purchasing property in South Florida can be tricky business and you should always have a good buyer’s agent on your side. This is even more important if you are considering a condo purchase. With hundreds of buildings to choose from, finding the right condo for you can be overwhelming. Many buyers are looking for that amazing ocean or Intracoastal view, but there is so much more to consider.

Just looking through pictures on the Internet doesn’t tell the whole story and in most cases you won’t find exactly what you’re looking for. Every condo association is different and they all have their own rules and regulations. Finding that perfect building and unit requires a local specialist. Here are some important questions a qualified buyer’s agent will be asking you:

- Do you have any pets? Every building has a different pet policy. The number of pets allowed and the different types of pets allowed varies. The weight and breed of your pet also needs to be approved by the association.

- Will you be renting your unit when you are not using it? Many buildings require new owners to wait 1-2 years before renting. Some do not allow renting at all.

- Who will be staying in your unit? Many buildings have restrictions on who can visit your unit without you being there. Sometimes only immediate family members are allowed unaccompanied and there is sometimes a limited amount of time that they can stay. Furthermore, many buildings require that anyone other than the parties on the deed must be approved before they can stay in your unit without you.

- Can you travel for an in-person interview if necessary? Don’t just assume that you can use Skype for your association interview. Many buildings require that you are there in person, so you may have to plan to visit the building before closing for your interview.

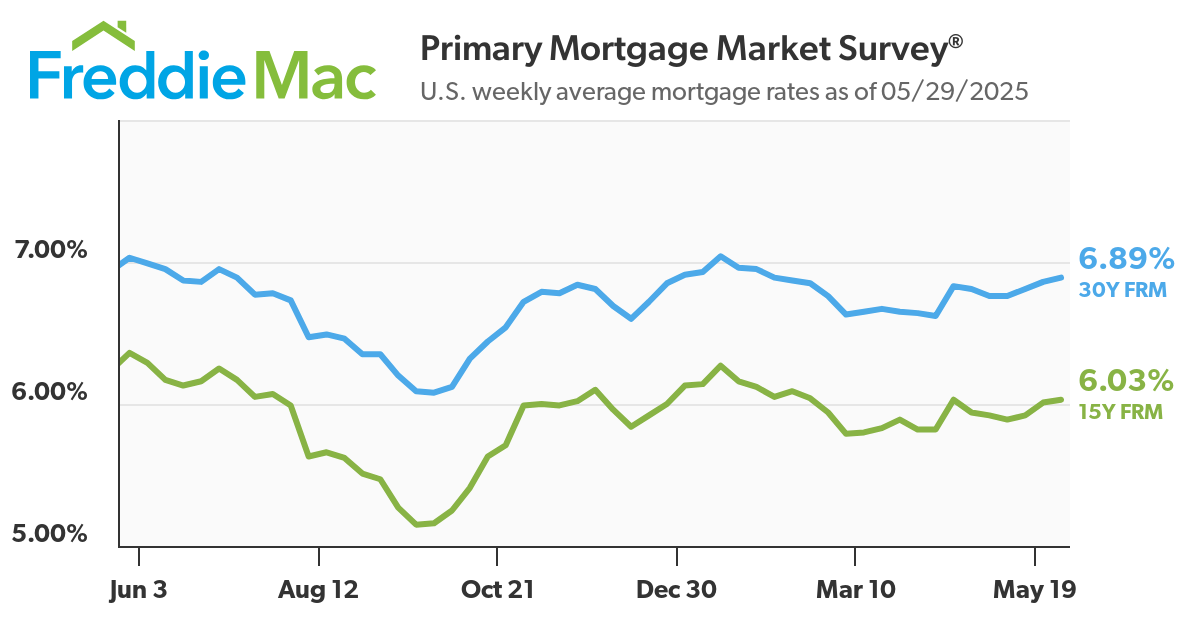

- Will you be paying cash for your condo or obtaining financing? “Cash is king” and is obviously preferable to sellers, but many buyers like the option of financing their purchase. If you plan on obtaining a mortgage and taking advantage of the low cost of borrowing money then there are things that your agent needs to confirm for you before you put in that offer. Just a few examples include does the building has reserves, do they require a minimum down payment and is there any current litigation?

- Are you working with a local lender experienced in condo mortgages? All lenders are NOT created equal, so having an experienced mortgage professional can make the difference between actually closing on your dream condo or having the deal fall apart because you chose the wrong lender for the job. A great buyer’s agent will know qualified mortgage professionals that you can trust, so ask your agent for a referral.

This is just a sample of the questions that need to be answered which is why having an experienced buyer’s agent will definitely help save you valuable time by narrowing down the buildings that will be a good fit for you based on your requirements. They can also help save you money! Many of the buyer’s shopping in our area are from out of town and will need to fly down to see the property before putting in an offer. Before you purchase that plane ticket talk with your buyer’s agent and make sure the building and unit will work for you.

Happy Condo hunting!