Florida’s Economy is Open. What’s Next?

There is no doubt that the Coronavirus (COVID-19) is having a profound effect on the economy around the world, and our local real estate market in the Fort Lauderdale area is no different. It is still a bit early to make any reliable predictions about the Fort Lauderdale market, but we do have some positive indications and new data that is worth discussing at this important juncture of the pandemic.

Before COVID-19

It is worth noting that before the Coronavirus pandemic started our local real estate market was fundamentally strong. We recovered quickly from the bottom of the market collapse in 2011 and have experienced a long sustained expansion ever since. With the exception of our luxury market segments, the Fort Lauderdale market was experiencing strong buyer demand in early 2020 as well as low to equilibrium inventory levels. Interest rates were low, unemployment was low and South Florida in general was considered a very desirable place to live (good news, it still is). 2020 was off to a great start! The northeast Broward county market had 1,421 sales in Q1 of 2020, up 4.3% from the prior year, and median prices jumped from $340,000 in Q1 2019 to $385,000 in Q1 2020, an increase of over 13%. We were poised for a very strong year, but then things quickly changed.

The Real Estate Market During Lock Down

On April 1st, like many places across the country, our economy was partially shut down when Governor DeSantis ordered residents to stay at home as well as the closure of non-essential businesses statewide. While real estate was considered an essential service, our ability to transact business was severely hampered due to limitations of in-person activities and the overall uncertainty among buyers and sellers. The effects were immediately apparent in the April data. Real estate closings in April were down 47% and the number of new listings on the market was down 45% compared to April 2019. Interestingly however, total inventory was only down 10% from last year and median prices actually rose 9.5% over April 2019 (see inventory analysis below).

So, the real estate marketplace was effectively cut in half, but we adapted and continued to transact business, albeit in a new unconventional fashion. We already had the technology, but getting used to the new virtual marketplace was not easy. Our agents have adapted, and the buyers and sellers who are active in our marketplace are adapting too. Demand is still strong and now that our economy in South Florida is opening up again buyers are emerging from behind their computers to compete in a marketplace with very little quality inventory to choose from.

Recovery is Dependent on Inventory

Supply and demand are principles we talk about often when evaluating the market, but inventory (supply) is frequently the more telling indicator of things to come in any given marketplace. When inventory is high, prices tend to flatten out or drop, and there are generally more desirable purchase opportunities for buyers. When inventory is low, prices tend to hold or increase and purchase opportunities for buyers are fewer and farther between. The latter is our current problem, so we need more inventory to keep the market moving for both buyers and sellers. The chart below demonstrates the dramatic drop in “new inventory” through April and then hopefully what we can expect when more new listings are added to the market.

Sure, demand is still high: website traffic, buyer property searches and showing requests all on the rise. But those are somewhat indefinite indicators of the future of our market. The only definite we can count on is inventory. When we start to see inventory levels return to normal, that is when we can expect our recovery to really kick in. Once that happens there is reason to believe that the Fort Lauderdale market will return to normal. We will definitely have fewer closings this year and median prices will rise only modestly, or maybe not at all, but overall the real estate market should be just fine and South Florida should recover quickly.

South Florida Is Unique

The real estate market in South Florida has always had a mind of its own and this recovery is no different. Consider the following factors and how they will contribute to a quick recovery.

- While unemployment is still a wildcard for the entire economy, the effect should be lower in our market since buyer demand is not entirely dependent on resident buyers with local jobs. Our market attracts retirees (not part of the job market), second home owners and investors, foreign and domestic.

- Florida already had strong demand due to our weather and favorable tax structure. This demand should increase as city folks from northern states who endured the pandemic indoors are drawn to our climate, open spaces and accessible outdoor activities. Where would you rather be during a pandemic?

- Our large percentage of second home ownership should help with our supply shortage in the low to mid price ranges since some second homeowners may be forced to sell their vacation homes because of financial hardship. When times are tough you sell your vacation condo, not your primary residence.

More Market News Related to Coronavirus

Will We See More Foreclosures in Florida?

By The Sea Realty COVID-19 Policies

New Technology for Virtual Real Estate

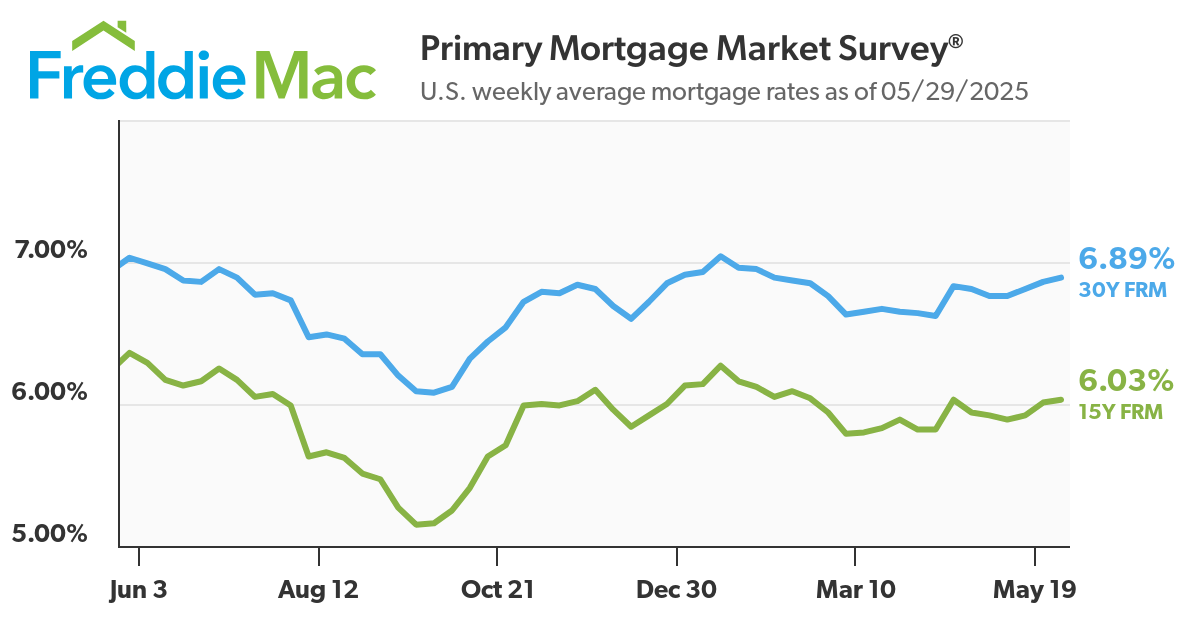

Mortgage Rates Hit All Time Lows

*All data is from Beaches MLS and includes the following communities in Northeast Broward County: Fort Lauderdale, Pompano Beach, Lauderdale-by-the-Sea, Lighthouse Point, Hillsboro Beach, Deerfield Beach, Oakland Park and Wilton Manors. Sales and inventory data include single family homes and condominiums.