The Florida Association of Realtors consolidates local association data from across the state and provides the previous month’s data to member Realtors through the SunStats reporting system. We then analyze the data for our local South Florida markets and generate this summary report and infographics for Broward, Miami-Dade and Palm Beach Counties.

Single Family Home Sale Prices Up, Condo Sale Prices Down

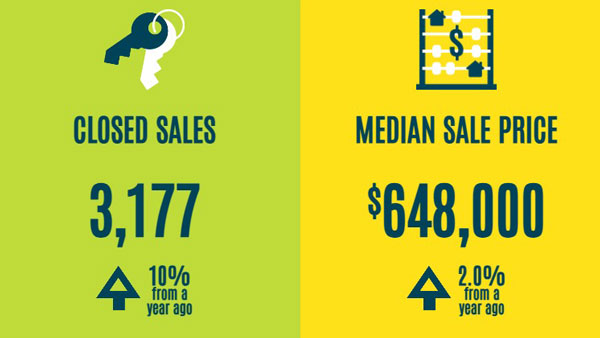

Median sale prices in South Florida are mixed year over year, with single family home prices up and condo prices down. Housing supply is up in both segments, however there are signs that inventory is slowly finding it’s equilibrium. Sales volume is still well below normal across all market segments.

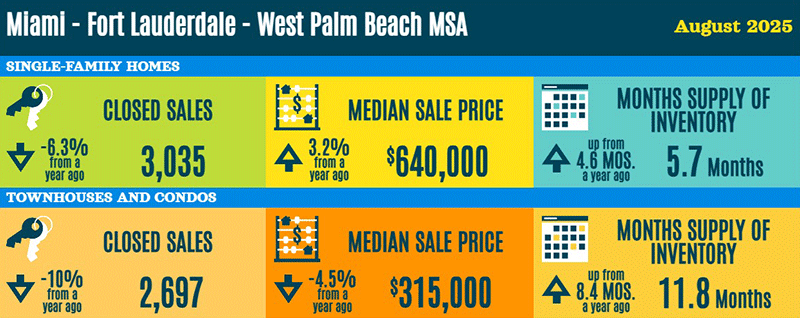

Single family home sales were down 6.3% from last year in the tri-county area, while median sale prices were up 3.2% to $640,000. This is just below the peak of $650,000 in May of this year. Single family inventory is still relatively low at only 5.7 months of supply, which is likely the reason median sale prices remain strong. This is still a seller’s market, but trying to find an equilibrium.

Closed condo sales in South Florida were down 10% from last August. Median sale prices were also down 4.5% to $315,000. This is well below the peak of $355,000 in May of 2024. Condo supply in South Florida was up year over year, but trending downward for the past 3 months. This is a buyer’s market across the entire tri-county area.

Condo volume and median sale prices were both down, and inventory was up year over year. This is a buyer’s market.

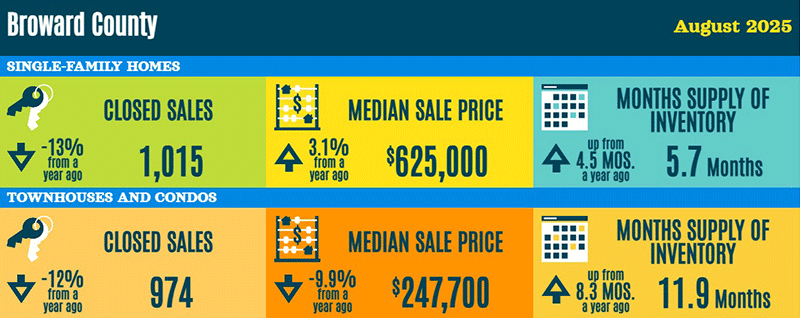

Broward County

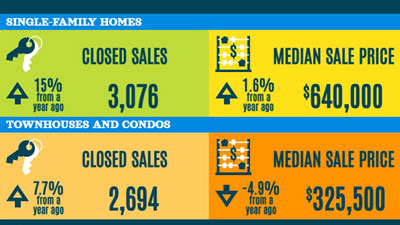

The median sale price for a single family home in Broward County was up 3.1% to $625,000. This is slightly down from the peak of $640,000 in January. Inventory remains low at 5.7 months of supply. Like the rest of South Florida, this is still a seller’s market, but very close to equilibrium.

The median sale price for condos and townhomes in Broward County was down almost 10% from last year. This is down from the peak of $290,000 in February of 2024 and the lowest prices have been since April of 2022. Condo inventory in Broward was up to 11.9 months of supply, but showing signs of flattening.

The median sale price for condos and townhomes in Broward County was down almost 10% from last year, the lowest since April of 2022.

Broward County, Florida includes the coastal communities of Fort Lauderdale, Pompano Beach, Lauderdale-by-the-Sea, Lighthouse Point, Hillsboro Beach and Deerfield Beach.

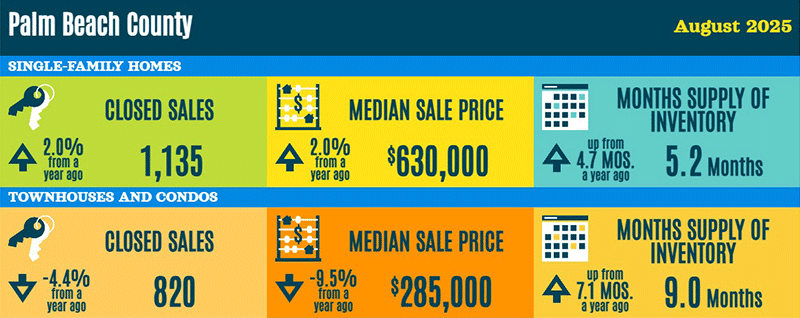

Palm Beach County

The median sale price of a single family home in Palm Beach County was up a modest 2% to $630,000, still off the peak of $660,000 in June of last year. Single family inventory was also up slightly, but remains very low at only 5.2 months of supply. This is a fairly strong seller’s market.

The median sale price of condos and townhomes in Palm Beach County declined 9.5% to 285,000. Condo inventory in Palm Beach is still the tightest in South Florida with only 9 months of supply.

Single family inventory in Palm Beach County increased slightly, but was still the lowest in South Florida with only 5.2 months of supply.

Palm Beach County, Florida includes the coastal communities of Boca Raton, Delray Beach, Boynton Beach, Lantana, Manalapan, West Palm Beach, Singer Island, North Palm Beach, Juno Beach and Jupiter.

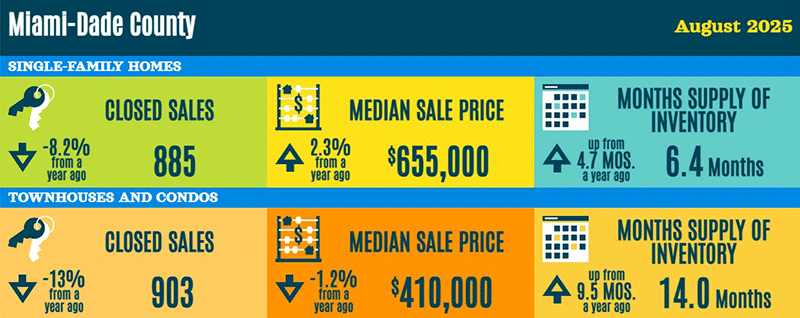

Miami-Dade County

The median sale price of a single family home in Miami-Dade County was up 2.3% from last year to $655,000. This was still down slightly from the peak of $675,000 in January. Inventory increased slightly to 6.4 months of supply. This is still a seller’s market, but approaching equilibrium.

The median sale price of condos and townhomes in Miami Dade County was down 1.2% to $410,000 which is also down from its peak in February of $455,000. Inventory increased to 14 months of supply. This is the most condo inventory in South Florida.

Condo inventory in Miami-Dade County is the highest in South Florida at 14 months of supply.

Miami-Dade County includes the coastal communities of Miami, Miami Beach, Sunny Isles Beach, Golden Beach, Bal Harbour, Surfside and Key Biscayne.

Summary

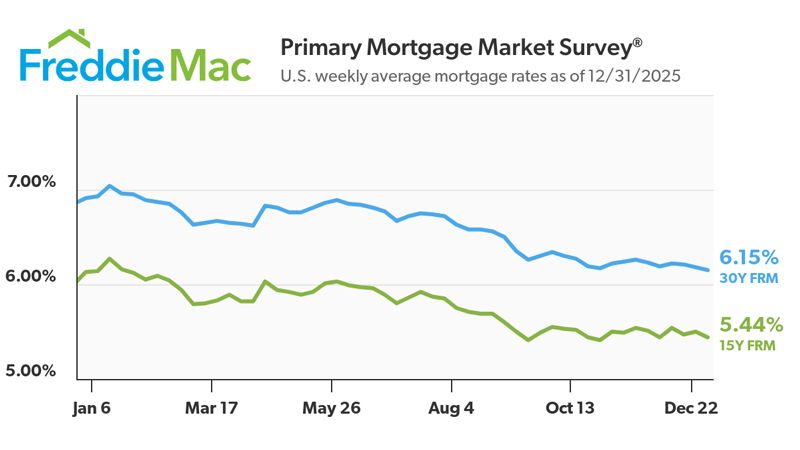

Our single family markets seem to have found their equilibrium, with both inventory and median sales prices flattening. Sales volume is still historically low, but with mortgage interest rates down, we expect more buyers to enter the marketplace. With inventory still favoring sellers, we also expect prices to return to normal appreciation rates. The single family market feels normal again. For primary home shoppers looking for a fair deal, now is a good time to buy before the winter season demand picks up. Find an agent who specializes in our local market. Their hard work, patience and local knowledge will pay off.

The condo market seems to be finding its bottom, with more associations getting in compliance with their required inspections and reserve studies. With the help of experienced local Realtors, more buyers are getting comfortable buying into older condo buildings, and it is paying off. Condos are now selling at 91.4% of list price, the lowest list-to-sell ratio since 2011. Lower interest rates are not affecting the condo market as much, with about half of condos selling for cash. Make sure you are working with an experienced local agent who can help you navigate the due diligence required in purchasing a condo.

Are you thinking of selling? Every seller situation is different, so its hard to say if now is your best time to sell. For example, if you own a single family home in a tight market and you are considering downsizing to a smaller condo, then now might be a perfect time. Consult with your By The Sea Realty agent to determine your best sell/buy strategy. We utilize a suite of seller tools to help you accomplish your real estate goals. Its starts with our industry leading Cloud CMA.

For a detailed market analysis of your condo or single family home, or for professional assistance with your home search in South Florida please contact one of our local trusted agents.