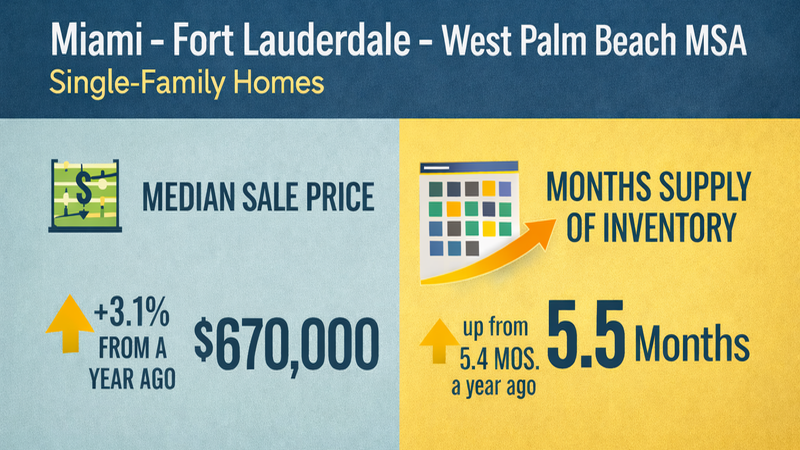

Single Family Prices Up Slightly, Condos Starting to Recover

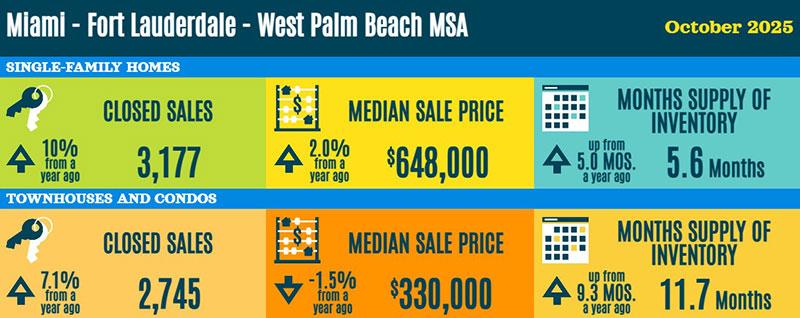

Median sale prices were mixed across South Florida in October, with single family homes showing modest appreciation while condo prices were down slightly year over year. However, the condo market is showing signs of recovery with condo prices increasing over the past 2 months. Inventory rose year over year in both segments, with signs that the overall market finds its equilibrium. Sales volume increased across all market segments, showing strong buyer activity just ahead of the winter buying season.

Single family closed sales in the tri-county area were up 10% from last year, while the median sale price increased 2% to $648,000. Inventory rose slightly to 5.6 months of supply, down from the recent peak of 6.1 months last June. The single family market has definitely found its equilibrium.

Closed condo sales across South Florida rose 7.1%, but median sale prices fell 1.5% to $330,000. Inventory climbed to 11.7 months of supply, also down slightly from its peak in May of 12.4 months. While not as certain, condos seem to be finding their equilibrium as well.

South Florida Real Estate Statistics – October 2025

October 2025 SunStats Real Estate Data for the entire South Florida Metropolitan Statistical Area

The South Florida condo market is showing signs of recovery, with median sale prices increasing for 2 consecutive months.

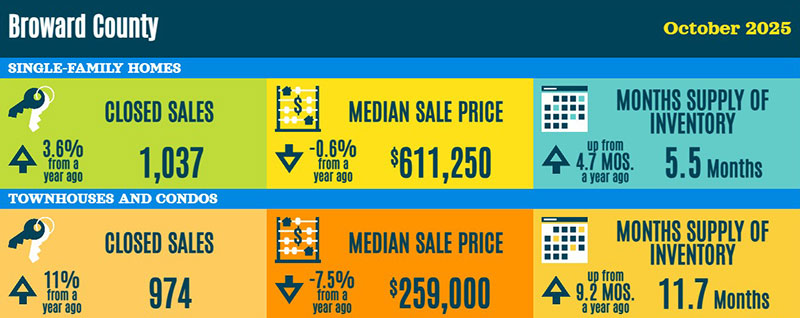

Broward County

The median sale price for a single family home in Broward County decreased 0.6% year over year to $611,250. Inventory rose to 5.5 months of supply, up from 4.7 months a year ago. Like the overall tri-county market, Broward’s single family segment has found its equilibrium.

The median sale price for condos and townhomes in Broward County dropped 7.5% to $259,000, the largest decline in the region, but up from its bottom of $248,000 in August. This is accompanied by a rise in inventory to 11.7 months, up from 9.2 months last year. With lower prices and increased supply, buyers are returning to the Broward condo market, keeping inventory in check.

Broward County Real Estate Statistics – October 2025

October 2025 SunStats Real Estate Data for Broward County, Florida

With lower prices and increased supply, buyers are returning to the Broward condo market, keeping inventory in check.

Broward County, Florida includes the coastal communities of Fort Lauderdale, Pompano Beach, Lauderdale-by-the-Sea, Lighthouse Point, Hillsboro Beach, and Deerfield Beach.

Palm Beach County

The median sale price for a single family home in Palm Beach County rose 3.5% year over year to $643,000, with closed sales up an impressive 19%. Inventory increased slightly to 5.1 months of supply, making this the tightest single family market in South Florida.

Condos and townhomes in Palm Beach County saw median prices increase 3.3% to $315,000, a notable exception in the region and a strong rebound from the low of $285,000 in August. Inventory rose to 9.1 months of supply, up from 8.0 months last year. Despite the increase in supply, Palm Beach remains the most balanced condo market in the tri-county area.

Palm Beach County Real Estate Statistics – October 2025

October 2025 SunStats Real Estate Data for Palm Beach County, Florida

Palm Beach County’s single family segment remains one of the strongest in South Florida, with rising prices and low inventory.

Palm Beach County, Florida includes the coastal communities of Boca Raton, Delray Beach, Boynton Beach, Lantana, Manalapan, West Palm Beach, Singer Island, North Palm Beach, Juno Beach, and Jupiter.

Miami-Dade County

The median sale price of a single family home in Miami-Dade County increased 1.7% to $682,000, with closed sales up 6.9% year over year. Months of supply rose from 5.2 to 6.5, placing Miami-Dade’s single family market closest to technical equilibrium among the three counties.

Condo and townhome prices in Miami-Dade fell 3.6% year over year to $400,000, while inventory increased significantly to 13.9 months of supply. Miami-Dade continues to have the most condo inventory in South Florida. The question is if winter buyers will absorb this extra inventory, or will it continue to escalate.

Miami-Dade County Real Estate Statistics – October 2025

October 2025 SunStats Real Estate Data for Miami-Dade County, Florida

Condo inventory in Miami-Dade County remains the highest in South Florida at nearly 14 months of supply.

Miami-Dade County includes the coastal communities of Miami, Miami Beach, Sunny Isles Beach, Golden Beach, Bal Harbour, Surfside, and Key Biscayne.

Summary

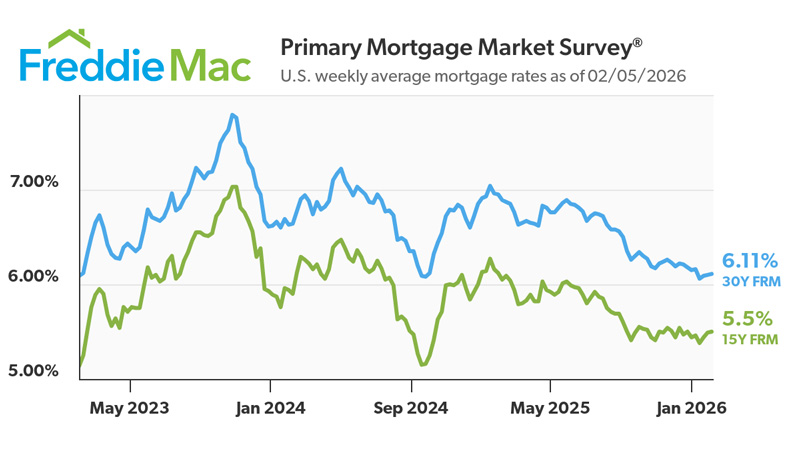

The single family market across South Florida continues to stabilize, with rising sales, modest price appreciation, and inventory levels moving closer to long-term norms. With mortgage interest rates improving and buyer activity increasing, we expect continued momentum heading into the winter season. Buyers entering the market will find more choices than in previous years, while sellers can still benefit from relatively strong pricing and demand.

The condo market continues to work through elevated supply and structural challenges that have affected pricing over the past two years. However, more buildings are completing required inspections and reserve studies, boosting buyer confidence. As a result, sales volume continues to increase. Condos are selling at lower list-to-sell ratios than earlier this year, offering opportunities for informed buyers working with knowledgeable agents.

If you’re considering selling, timing depends on your specific situation. Single family homes remain strong, while condominiums require a more strategic approach to pricing and preparation. Whether you are buying, selling, or evaluating your options, our experienced agents at By The Sea Realty are ready to guide you with local insight and market expertise.

Source: Florida Realtors SunStats, October 2025.