Have you been thinking about upgrading your house, but find yourself procrastinating or wondering if the real estate market has yet to find a bottom? If you are fortunate enough to have the income and resources necessary to sell your current home and upgrade to your dream home, then now is the time. In many parts of the country, we’ve already seen the bottom of the market and if you haven’t seen it in your market, then it is probably closer than you think. Even if I’m wrong and values continue to drop (they will in some markets), if you wait for the absolute bottom, you’ll miss it and you may never have the opportunity to buy your dream home again. Please note: this post is about upgrading your personal residence and assumes you will stay in your new home for at least 10 years. This math is not necessarily for investors or real estate speculators (although they may still learn a thing or two). There will not be a test at the end of this blog.

It’s Time To Trade Up: 3 Reasons It Makes Sense

- By trading up, you’ll likely make more money in the long run than you would just staying put. Here is how the math works. Let’s say you paid $500,000 for you house 5 years ago and the market has depreciated 30% since then, so your house is now worth$350,000. You are now $150,000 in the hole, right? Well, the answer is yes, unless you take advantage of the buyer’s market and upgrade. Let’s say your dream house that you couldn’t afford 5 years ago was $1,000,000 and now you can buy it for $700,000. So with the $300,000 discount on the new house you are already $150,000 ahead on the trade-up ($129k after commissions). Wait, it gets better. Let’s say in 10 years your new home has appreciated another 30% which equals $210,000 versus the $105,000 you would have gained on your original home. That’s a $105,000 difference in gain for a total upgrade benefit of $234,000!

- It is better to trade up in a down market than in an escalating market. If you wait for the market to improve, it will cost you on the upswing. Let’s say that you wait 3 years to buy and the market goes up 10%. Your $350,000 house is now worth $385,000 and your dream home is now worth $770,000 so you’ve lost another $35,000 by waiting. I know what you’re thinking, “But if the market keeps going down, then I’ll be able to buy my dream house for even cheaper”. Sure, that could happen, but once again, if you wait for a true bottom then you’ll probably miss it. And, have you considered the effect of interest rates changes?

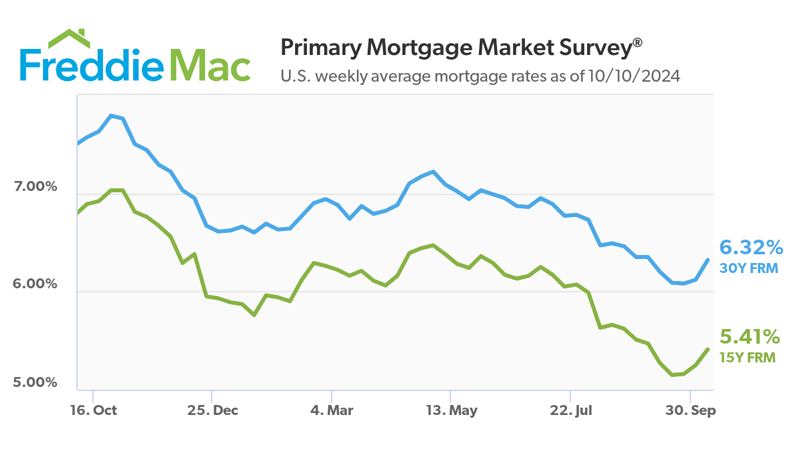

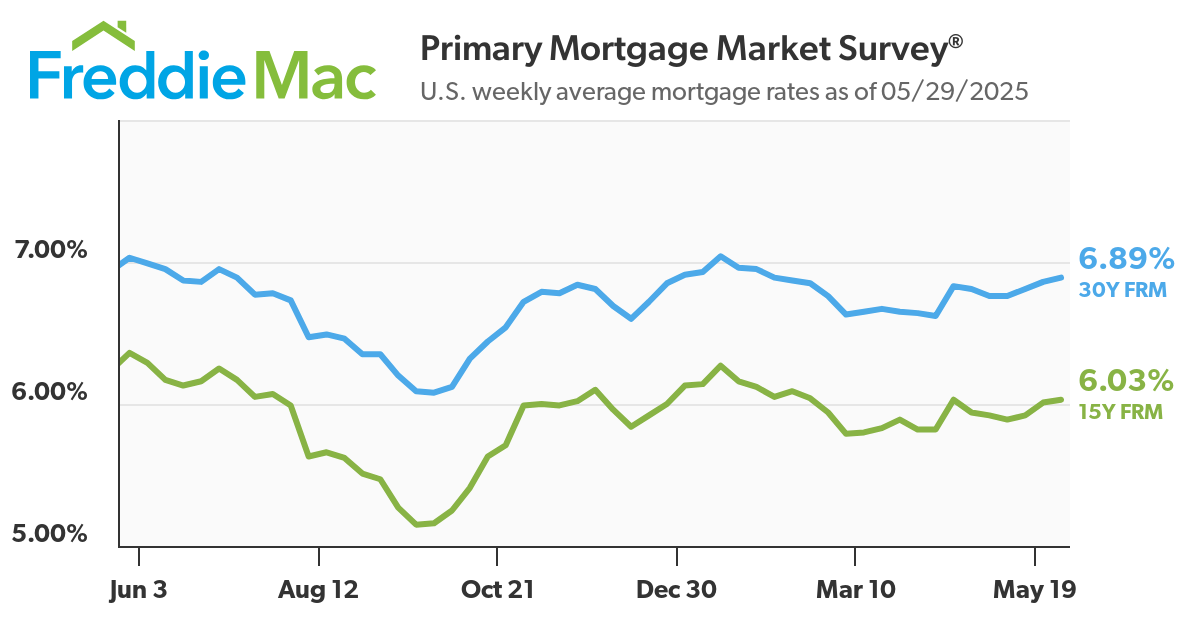

- If you will be financing your upgrade, let’s assume that interest rates are going up. You really don’t think rates are going to stay this low forever, do you? Current interest rates have been hovering around 5%, the lowest in 40 years. So, yes, they are going back up and it will likely be a long time before we see them this low again (if ever). Here is the math on interest rates. Let’s assume that you will stay in your new home for 10 years. After all, it is your dream home. If you put 20% down on your $700,000 home, you will borrow $560,000 which will cost you about $256,000 in interest (not including principal) over 10 years at today’s rates (5%). If rates go up only one point to 6% on a 30 year fixed mortgage, you will pay an additional $56,000 in interest over 10 years. If rates go to 7% (still historically low), it will cost you $112,000 more, and so on.

The bottom line is that if you are considering an upgrade and if you have the resources, there is no better time than the present. Oh, I almost forgot; if you qualify for the new home-buyer tax credit, there is another $6,500 benefit to you if you get under contract by April 30 and close by June 30, 2010. See my post: “Homebuyer Tax Credit Extended, Includes Current Homeowners” for more information. If you want to run these numbers on your actual situation then please give us a call. We have a special calculator that does the math for you.