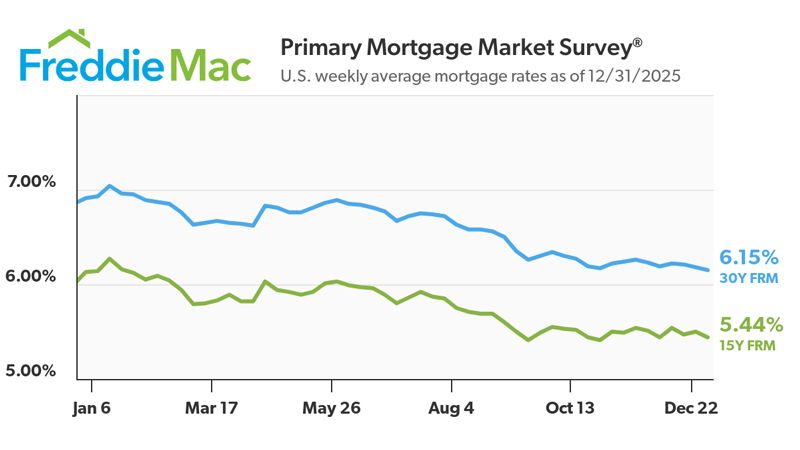

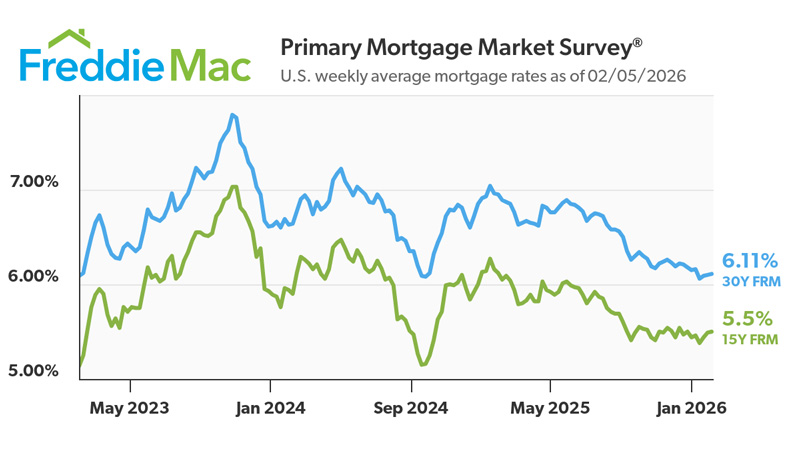

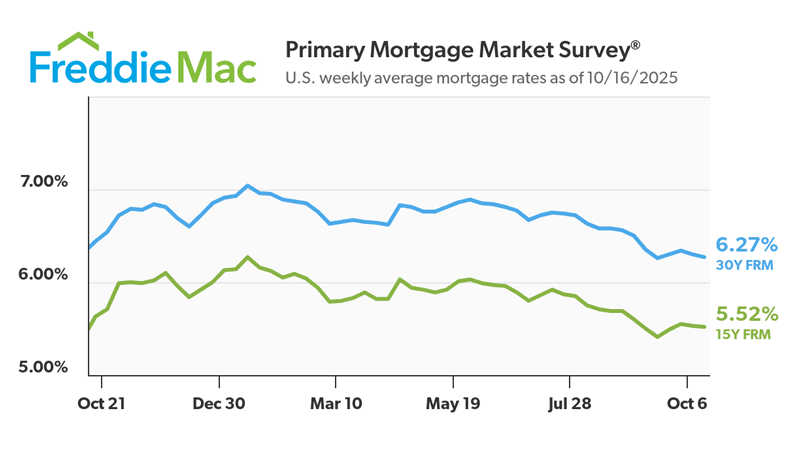

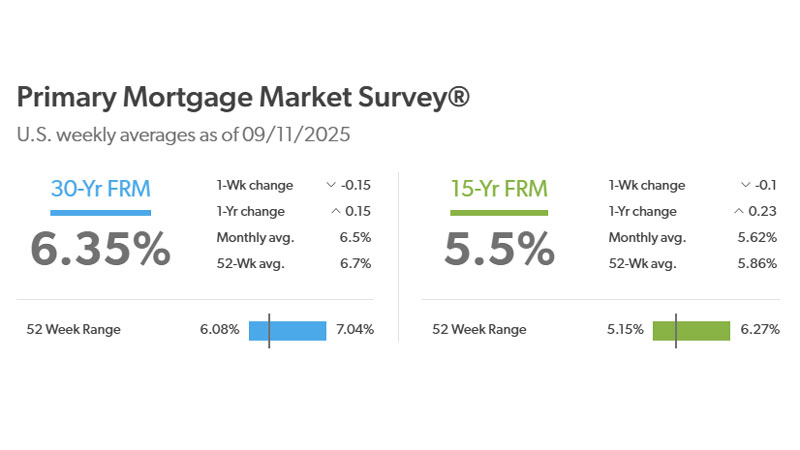

The 30 year fixed rate mortgage has dropped again this week, averaging 6.15%. The 15 year fixed is at 5.44%. These are the lowest rates we have seen for all of 2025. While this is great news, the better news is that mortgage rates have found a relative balance after a period of volatility. Buyers seem to have accepted the new normal in the low 6% range.

How are lower rates affecting the market in South Florida? Demand is up as more buyers take advantage of the lower rates. More condo buildings are completing their required milestone inspections and meeting their reserve requirements, opening the door to qualified mortgages. Inventory seems to be finding its equilibrium and median prices are expected to increase again in 2026. Simply put, it feels like a normal real estate market in South Florida. If you are planning on financing your purchase, then now might be the perfect time to get back into the market. Call your Realtor and loan officer. We are here to help.