Supply Returns to Normal Equilibrium As Demand Slowly Increases

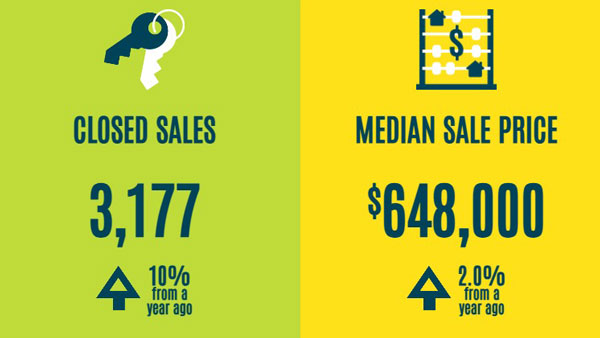

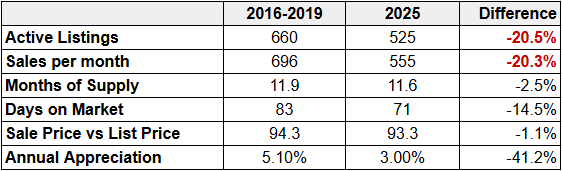

What does a normal single family waterfront market look like? Most of us in the real estate business consider 2016-2019 to be the most normal years in recent history. This is the period of time between the Great Recession hangover and the pandemic shock. Many of the real estate statistics we follow are back in the normal range, with the exception of active listings and closed sales, which are both below normal by about 20%. However, demand is slowly increasing. As long as we continue to add new inventory, we can expect sales volume to return to normal levels soon.

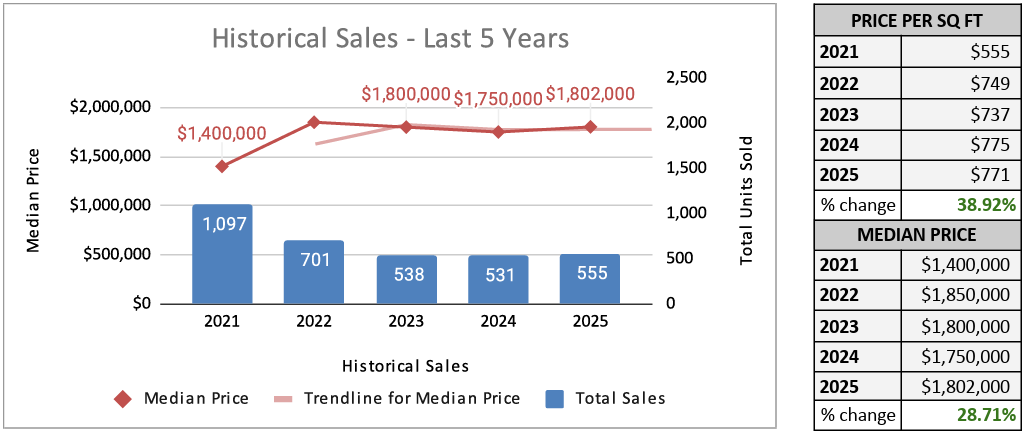

The median sale price of a single family waterfront home was up slightly in 2025 to $1,802,000. This was an increase of about 3% over the previous year and a welcome trend for waterfront home owners. Median sale prices spiked massively in 2021 and 2022. Since then we have experienced a 3-year market correction, with median sale prices essentially flat. We expect annual price appreciation to return to normal this year, which is historically in the 4-6% range.

The Normal Years: 2016-2019 Compared to 2025

The Single Family Waterfront Market is slowly getting back to normal, with the exception of Active Listings and Sale Volume, which are both about 20% below normal levels.

All Northeast Broward County Historical Sales of Ocean Access Single Family Homes

Read The Entire Northeast Broward Market Watch Report

Local Market Watch – NE Broward Waterfront Communities

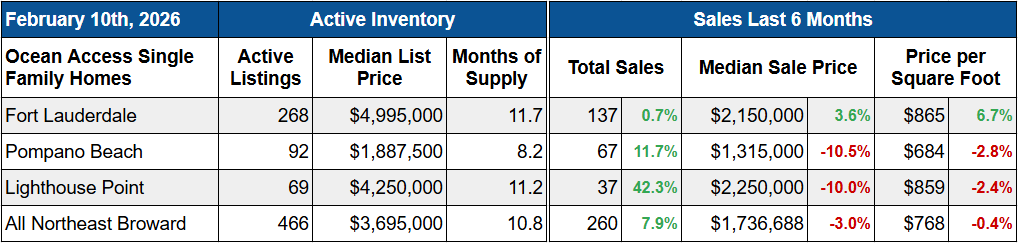

Northeast Broward County has the most plentiful supply of ocean access lots in all of South Florida. They don’t call this the Venice of America for nothing. The majority of our waterfront homes are located in Fort Lauderdale, Pompano Beach and Lighthouse Point.

Fort Lauderdale

Inventory levels in Fort Lauderdale are also close to normal at 11.7 months of supply. Sales volume has been relatively flat. Buyers and sellers are negotiating fair deals with homes selling for 94% of list price on average. This normal sale price to list price ratio is another indicator of an equilibrium market.

Fort Lauderdale is leading the median sale price recovery. The median sale price of an ocean access home in Fort Lauderdale was $2,150,000 over the last 6 months and $2,300,000 for all of 2025. That is a dramatic increase of 17.9% over the previous year. Sale price per square foot also increased to $869, a 9.2% increase over the previous year. This is no surprise however, since Fort Lauderdale is the star of our waterfront communities and it tends to lead market recoveries.

Median sale prices and price per square foot of waterfront homes in Fort Lauderdale were up 17.9% and 9.2% respectively.

Read The Entire Fort Lauderdale Market Watch Report

Pompano Beach

Single family waterfront homes continue to be in high demand in Pompano Beach. The inventory is still the lowest in NE Broward at only 8.2 months of supply. Sales volume is also strong with the largest year over year increase of almost 15%.

The median sale price of a single family waterfront home in Pompano took a hit in 2025, dropping to $1,265,000, still the lowest in NE Broward. However, this price drop is likely a market correction and the result of a large median sale price increase in 2024. With such low inventory and the best value in the marketplace, it is likely prices will jump back up again this winter season.

Single family waterfront homes continue to be in high demand in Pompano Beach. The inventory is still the lowest in NE Broward at only 8.2 months of supply.

Read The Entire Pompano Beach Market Watch Report

Lighthouse Point

Inventory in Lighthouse Point is on par with the rest of the overall market with 11.2 months of supply. Sales volume increased substantially over the last 6 months with 37 waterfront sales, an increase of 42.3% over last year.

The median sale price in Lighthouse Point is down 10% in the past 6 months. However, looking at all of 2025, the median sale price is up 27.5% to $2,550,000. This is due to a high number of luxury sales earlier in the year. This is a smaller market than neighboring Pompano Beach and Fort Lauderdale, so inventory and median prices tend to fluctuate more.

Sales volume in Lighthouse Point increased substantially over the last 6 months with 37 waterfront sales, an increase of 42.3% over last year.

Read The Entire Lighthouse Point Market Watch Report

Summary

The past five years have been anything but typical. An unprecedented surge in demand led to sharp price increases and historically low inventory levels. As has always been the case, the market has begun to self-correct, and conditions are gradually returning to a more balanced and sustainable environment.

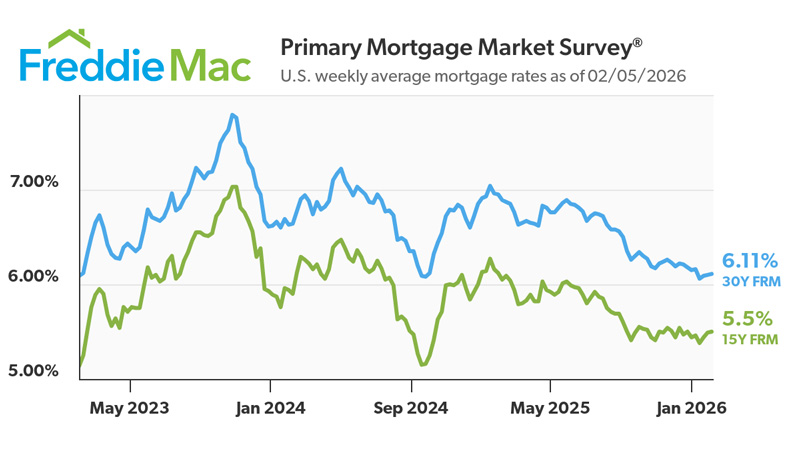

Looking ahead to 2026, sales activity is expected to increase as more buyers re-enter the market, driven by pent-up demand, normalized inventory levels, and more favorable interest rates. Median sale price growth should stabilize, aligning with long-term historical averages of approximately 4-6% annually. As balance returns, both buyers and sellers can anticipate a healthier market, with fair price negotiations and mutually successful real estate transactions along the waterfront.

Buying and selling waterfront property can be tricky business these days. Please make sure you have a local waterfront specialist to assist you.