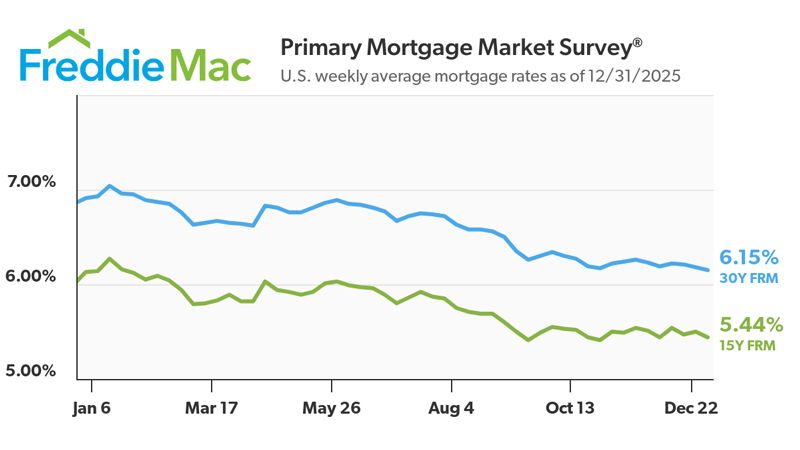

Mortgage Rates Drop to Lowest Level of the Year

The 30 year fixed rate mortgage has dropped again this week, averaging 6.15%. The is the lowest level for all of 2025.

The 30 year fixed rate mortgage has dropped again this week, averaging 6.15%. The is the lowest level for all of 2025.

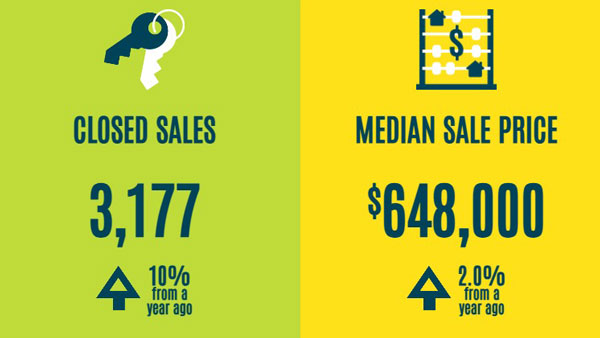

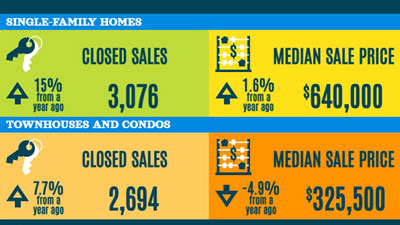

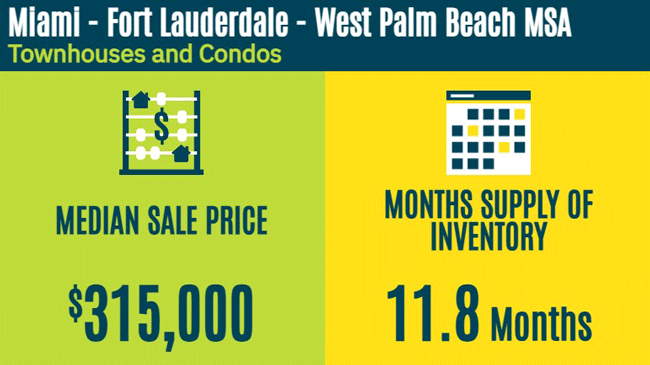

Median sale prices across South Florida were mixed in November, with single family home prices generally flat, while condo prices were down year over year.

South Florida single family home prices are up slightly while condo prices soften a bit. Check out our SunStats data & expert insights for Fort Lauderdale, Miami and Palm Beach.

Single family prices remain stable year over year, supported by relatively tight supply and steady demand. Condos, on the other hand, continue to show price weakness, with inventory rising.

Inventory is currently at 9.7 months, which is in the range of equilibrium, and median prices are trending upwards. It feels like a normal market again.

Welcome to a normal condo market. Oceanfront condo inventory peaked at about 16 months last Spring, and has slowly been absorbed to our current level of 11.2 months of supply.

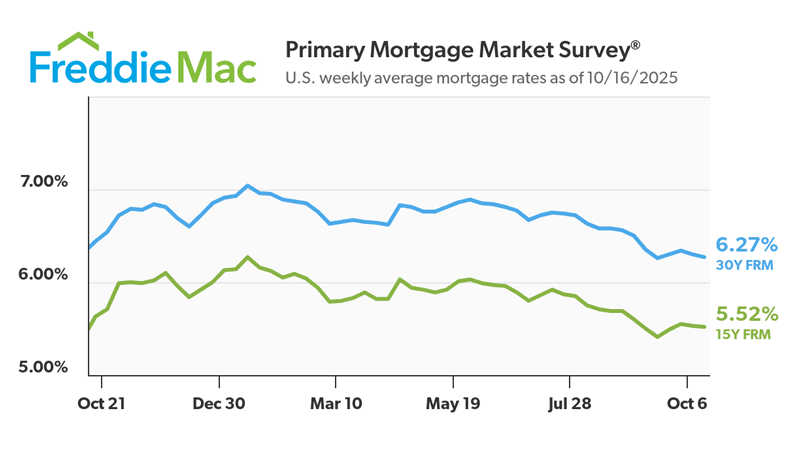

The 30 year fixed rate mortgage has dropped again this week, averaging 6.27%. Rates have settled into their lowest levels in about a year.

The Fort Lauderdale International Boat Show 2025 is here. Check out our boat show tips for the beast experience.

If you’ve dined much around South Florida, chances are you’ve spotted grilled octopus on many local menus from Palm Beach to Fort Lauderdale to the Florida Keys. This Mediterranean favorite

Sell Faster and For More Money Showcase is a premium listing experience on Zillow that offers your home the best marketing exposure with dedicated emails to interested buyers and premium

Buyers are getting comfortable with older condo buildings and as a result they are getting some amazing deals. Condos are now selling at 92.7% of list price, the lowest list to sell ratio in 13 years.

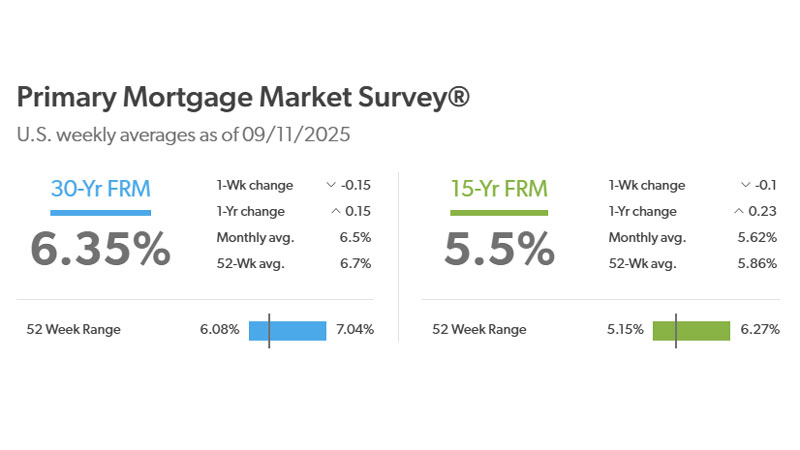

The 30 year fixed rate mortgage has dropped to an average of 6.35%. These are the lowest rates we’ve had since since October of 2024.