Sales Still Sluggish, but Prices are Still Going Up in South Florida

December sales volume was down again in December, ending a year of sluggish sales for the South Florida real estate market. However, both median sale prices and months supply of inventory are up year over year in December. We are also getting some much needed relief from the mortgage markets with mortgage interest rates down to their lowest levels since June of 2023. These are all signs that our market is slowly returning to normal and its just in time for our busy winter season.

Closed sales in South Florida were down slightly in December, but the median sales price of a single family home was $585,400, up 9.4% year over year. This is still down from the peak of $623,500 in June of last year. Months supply of inventory for single family homes reached 3.9 months which is the highest level since June of 2020, but still a seller’s market.

The median sale price for condos and townhomes reached $332,175 up 7.5% from a year ago and just below the peak from last month of $340,000. Just like single family homes, condo inventory is at its highest level in almost 3 years. 5.7 months of supply is approaching an equilibrium meaning its not really a buyer’s market or a seller’s market.

Condo and townhome inventory is at 5.7 months of supply. This is approaching an equilibrium, which is not a buyer’s or seller’s market.

Broward County

The median sale price for a single family home in Broward County was up 7.5% over last year, but still down from the peak of $615,000 in June of 2023. We experienced a similar drop last December before prices shot back up for 6 straight months through the winter and spring seasons. Single family inventory is still incredibly low at only 3.4 months of supply, which is the lowest inventory level in the tri-county area and very much a seller’s market. With such low inventory, seller’s are not very negotiable and we expect median sale prices to continue to increase.

The median sale price of a condo/townhome in Broward County is up year over year to $275,000. This is just below the 2023 summertime peak of $280,000. Inventory has slowly increased every month for almost 2 years. While technically this is still a seller’s market with 5.3 months supply, it is very close to equilibrium.

Single family inventory in Broward County is the lowest in the tri-county area at only 3.4 months of supply. This is very much a seller’s market and we expect prices to continue to increase.

Broward County, Florida includes the coastal communities of Fort Lauderdale, Pompano Beach, Lauderdale-by-the-Sea, Lighthouse Point, Hillsboro Beach and Deerfield Beach.

Palm Beach County

The median sales price of a single family home in Palm Beach County is up year over year to $580,000, but down from its peak of $625,000 last June. Inventory levels are the highest since June of 2020, but still very low at only 4 months of supply. This is still a strong seller’s market.

Median condo prices in Palm Beach County are up only slightly over last December to $305,000, but down from the peak of $325,000 in June of last year. Condo inventory is also up, but still a seller’s market with only 4.9 months of supply.

Single family inventory in Palm Beach County is still very low at 4 months of supply. This is still a strong seller’s market.

Palm Beach County, Florida includes the coastal communities of Boca Raton, Delray Beach, Boynton Beach, Lantana, Manalapan, West Palm Beach, Singer Island, North Palm Beach, Juno Beach and Jupiter.

Miami-Dade County

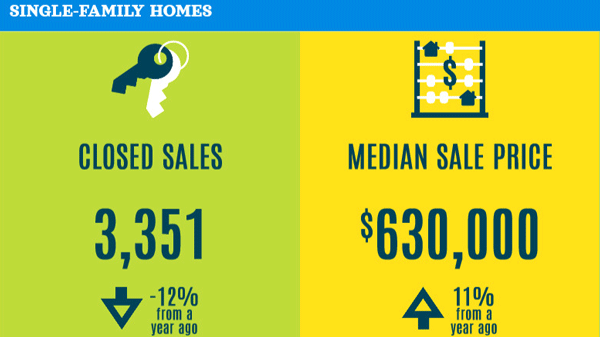

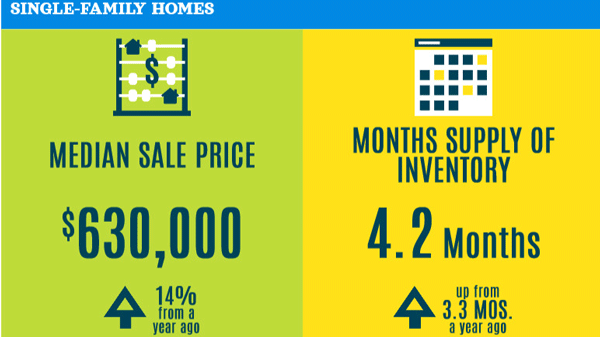

The median sale price of a single family home in Miami was up a whopping 15% over last December, but still below its peak of $631,670 in July of last year. This is the highest median sales price for single family homes in South Florida. However, inventory is the highest of the 3 counties, but still a seller’s market with only 4.3 months of supply.

Condo prices in Miami-Dade County are also up substantially over last year, and just below the peak of $620,000 last month. Inventory levels for condos remain the highest in South Florida at 6.8 months of supply. This is trending towards a buyer’s market, but it doesn’t appear to be affecting median sale prices, at least not yet.

Miami’s condo inventory is the highest in South Florida at 6.8 months of supply. This is trending towards a buyer’s market, but it doesn’t seem to be affecting median sale prices just yet.

Miami-Dade County includes the coastal communities of Miami, Miami Beach, Sunny Isles Beach, Golden Beach, Bal Harbour, Surfside and Key Biscayne.

Summary

December was a typically slow month for transaction volume, but median sale prices seem to be holding steady with inventory still low in most segments. Mortgage interest rates have come down over 1% from their peak in October and the Fed is hinting at further rate cuts this coming year. Our winter and spring seasons are typically very busy, but with lower rates there should be plenty of demand driving our market in the coming months. As long as inventory remains low and demand remains high we expect median sale prices to repeat last year’s upward trend.

For a detailed market analysis of your condo or single family home, or for professional assistance with your home search in South Florida please contact one of our local trusted agents.