Strong Start to 2026 for Single Family Homes, Condo Market Still Adjusting

South Florida’s housing market kicked off 2026 with solid single family price growth and steady inventory levels across the tri-county area. Condo markets remain under pressure in some counties, but sales activity suggests buyers are actively engaging where pricing has adjusted appropriately.

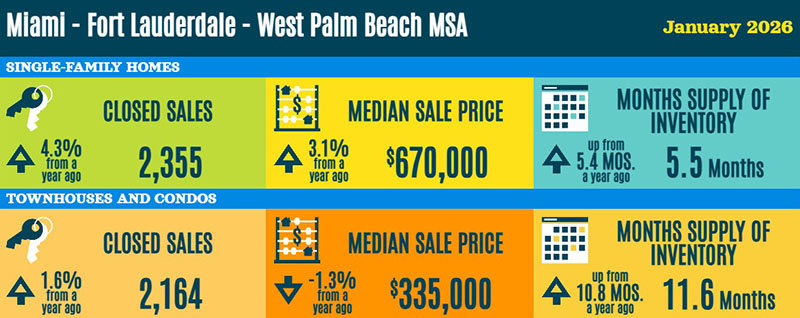

Single family closed sales in the tri-county area increased 4.3% year over year to 2,355 sales. The median sale price rose 3.1% to $670,000. Inventory held steady at 5.5 months of supply, up from 5.4 months last year. Overall, the single family market remains balanced and stable heading into the winter season.

Closed condo sales increased 1.6% year over year to 2,164 sales, while the median sale price declined 1.3% to $335,000. Inventory stood at 11.6 months of supply, up from 10.8 months last year. The condo market continues to favor buyers, particularly in markets with elevated inventory.

South Florida Real Estate Statistics – January 2026

Single family median prices increased 3.1% year over year to $670,000 while inventory remained steady at 5.5 months of supply.

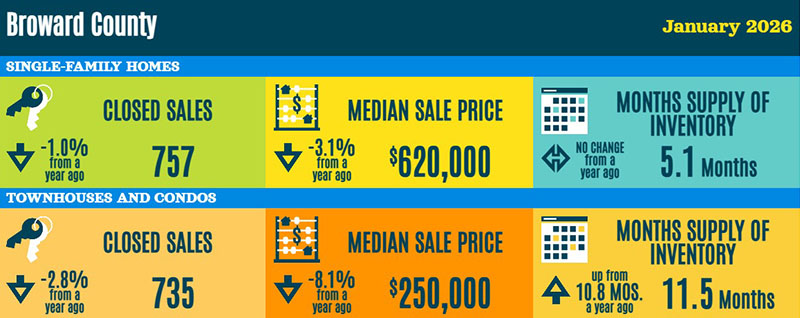

Broward County

Single family closed sales in Broward County declined 1.0% year over year to 757 sales. Median prices slipped 3.1% to $620,000. Inventory remained steady at 5.1 months of supply, unchanged from last year, keeping Broward near equilibrium.

Condo sales declined 2.8% to 735 sales, while median prices fell 8.1% to $250,000. Inventory rose to 11.5 months of supply, up from 10.8 months last year, continuing to favor buyers.

Broward County Real Estate Statistics – January 2026

Condo inventory in Broward climbed to 11.5 months of supply, continuing to create leverage for buyers.

Broward County includes the coastal communities of Fort Lauderdale, Pompano Beach, Lauderdale-by-the-Sea, Lighthouse Point, Hillsboro Beach, and Deerfield Beach.

Palm Beach County

Single family closed sales in Palm Beach County rose 10% to 937 sales. Median prices surged 7.7% to $700,000. Inventory declined to 5.2 months of supply, down from 5.5 months last year, making Palm Beach the tightest single family market in South Florida.

Condo sales increased 8.7% to 697 sales, while median prices declined 1.5% to $325,000. Inventory improved to 9.3 months of supply, down from 9.7 months last year, keeping Palm Beach the most balanced condo market in the tri-county area.

Palm Beach County Real Estate Statistics – January 2026

Palm Beach County’s single family median price jumped to $700,000, the strongest gain in South Florida.

Miami-Dade County

Single family sales in Miami-Dade increased 2.8% to 661 sales, while median prices rose 3.7% to $699,990. Inventory increased to 6.4 months of supply, up from 5.6 months last year, keeping Miami-Dade near technical equilibrium.

Condo sales dipped 0.1% to 732 sales, while median prices increased 1.2% to $420,000. Inventory rose to 13.7 months of supply, up from 11.9 months last year, the highest in South Florida.

Miami-Dade County Real Estate Statistics – January 2026

Miami-Dade condo inventory climbed to 13.7 months of supply, maintaining buyer leverage in the market.

Summary

South Florida’s single family market started 2026 with solid price appreciation and steady inventory levels across most counties. Palm Beach County led the region in price growth, while Miami-Dade maintained strong pricing near $700,000.

The condo market remains mixed. While pricing has softened in Broward and inventory remains elevated in Miami-Dade, steady sales activity suggests buyers are stepping in selectively where value exists.

As we move deeper into 2026, single family homes remain balanced and stable, while condo markets continue adjusting to higher inventory levels. Strategic pricing and local expertise remain essential in navigating today’s market.

Source: Florida Realtors SunStats, January 2026.