Single Family Prices Mixed, Condo Market Pulls Back Again

Median sale prices across South Florida were mixed in November, with single family home prices generally flat, while condo prices were down year over year. Inventory levels shifted modestly across both segments, but the overall market continues to show signs of stability as we move into the winter buying season. Sales volume remained strong compared to last year, confirming that buyer demand is still present.

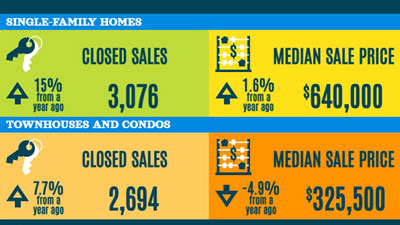

Single family closed sales in the tri-county area were up 13% from last year, while the median sale price held steady at $625,000, unchanged year over year. Inventory rose slightly to 5.5 months of supply, up from 5.2 months a year ago. The single family market remains very close to equilibrium, with balanced conditions between buyers and sellers.

Closed condo sales across South Florida increased 4.1%, but median sale prices declined 5.9% to $320,000. Inventory remained elevated at 11.7 months of supply, up from 10.0 months last year. Condos continue to favor buyers, particularly in older buildings and markets with higher supply.

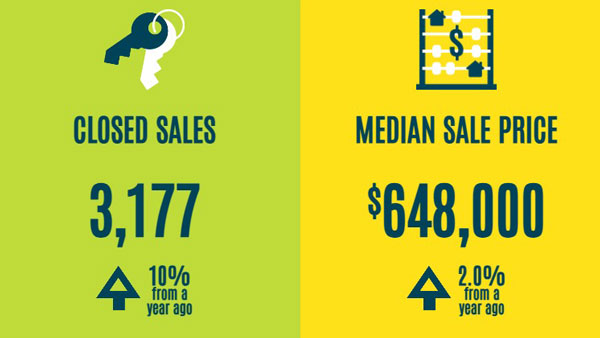

South Florida Real Estate Statistics – November 2025

The single family market remains stable across the region with sales up year over year, while condo prices softened further as inventory stayed elevated.

Broward County

The median sale price for a single family home in Broward County declined 3.1% year over year to $600,000. Inventory edged up to 5.2 months of supply, up from 4.9 months a year ago. Despite the modest price decline, Broward’s single family market remains well balanced, with conditions close to equilibrium.

The median sale price for condos and townhomes in Broward County fell 8.0% to $262,250. Inventory increased to 11.7 months of supply, up from 9.8 months last year. Sales volume was nearly flat year over year, suggesting that lower prices are helping to offset higher supply and keep buyer activity steady.

Broward County Real Estate Statistics – November 2025

With lower prices and elevated inventory, Broward County continues to offer opportunities for condo buyers willing to navigate due diligence and building requirements.

Broward County, Florida includes the coastal communities of Fort Lauderdale, Pompano Beach, Lauderdale-by-the-Sea, Lighthouse Point, Hillsboro Beach, and Deerfield Beach.

Palm Beach County

The median sale price for a single family home in Palm Beach County rose 0.8% year over year to $605,000, while closed sales increased a strong 19%. Inventory declined to 4.9 months of supply, down from 5.3 months last year, making Palm Beach the tightest single family market in South Florida.

Condos and townhomes in Palm Beach County posted a notable rebound, with median prices up 3.2% year over year to $320,000. Inventory rose modestly to 9.1 months of supply, up from 8.8 months last year. Palm Beach remains the most balanced condo market in the tri-county area.

Palm Beach County Real Estate Statistics – November 2025

Palm Beach County continues to stand out with strong single family demand and the healthiest condo market in South Florida.

Palm Beach County, Florida includes the coastal communities of Boca Raton, Delray Beach, Boynton Beach, Lantana, Manalapan, West Palm Beach, Singer Island, North Palm Beach, Juno Beach, and Jupiter.

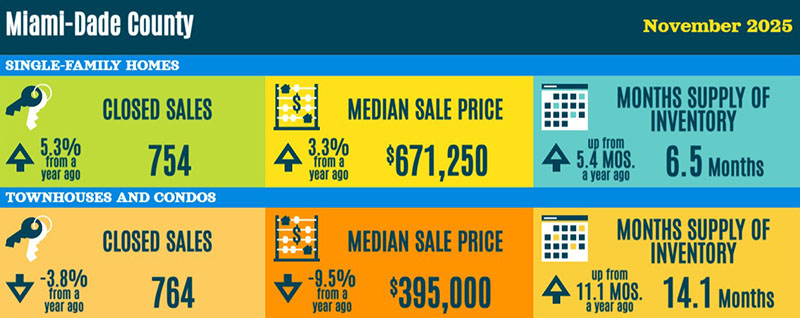

Miami-Dade County

The median sale price of a single family home in Miami-Dade County increased 3.3% year over year to $671,250, while closed sales rose 5.3%. Months of supply held steady at 6.5, keeping Miami-Dade closest to technical equilibrium among the three counties.

Condo and townhome prices in Miami-Dade declined 9.5% year over year to $395,000, while inventory increased slightly to 14.1 months of supply, up from 11.1 months last year. Miami-Dade continues to have the highest condo inventory in South Florida, creating significant leverage for buyers.

Miami-Dade County Real Estate Statistics – November 2025

Condo inventory in Miami-Dade County remains the highest in South Florida, keeping pricing pressure in place.

Miami-Dade County includes the coastal communities of Miami, Miami Beach, Sunny Isles Beach, Golden Beach, Bal Harbour, Surfside, and Key Biscayne.

Summary

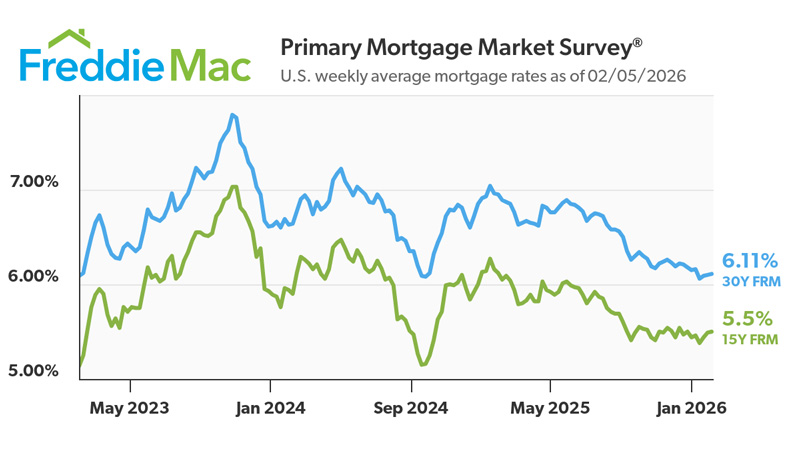

The single family market across South Florida remains stable as we move into the winter season. Sales activity is up year over year, inventory levels are healthy, and pricing is largely holding steady, indicating a market that has found its balance. Buyers have more choices than in recent years, while sellers continue to benefit from steady demand in well-located neighborhoods.

The condo market continues to work through elevated inventory and pricing pressure, particularly in Broward and Miami-Dade counties. While Palm Beach remains more balanced, buyers across South Florida are benefiting from improved negotiating power. As buildings complete milestone inspections and reserve studies, confidence should gradually improve, helping the condo market move closer to stability.

Whether you are buying, selling, or simply evaluating your options, working with an experienced local agent remains essential in navigating these shifting market conditions.

Source: Florida Realtors SunStats, November 2025.