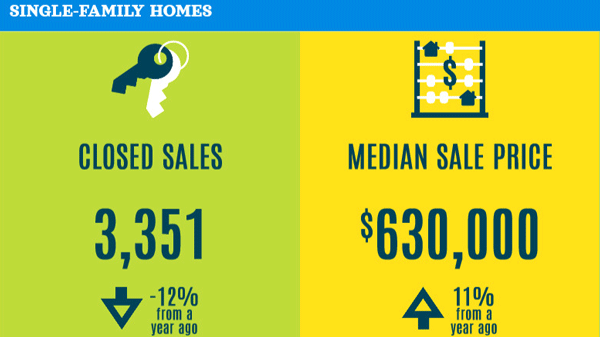

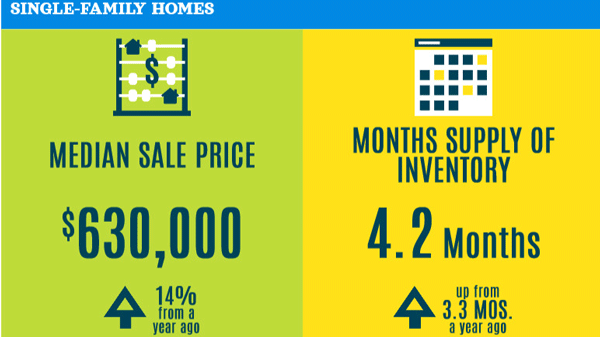

Affordability Is The Real Issue for Many Buyers

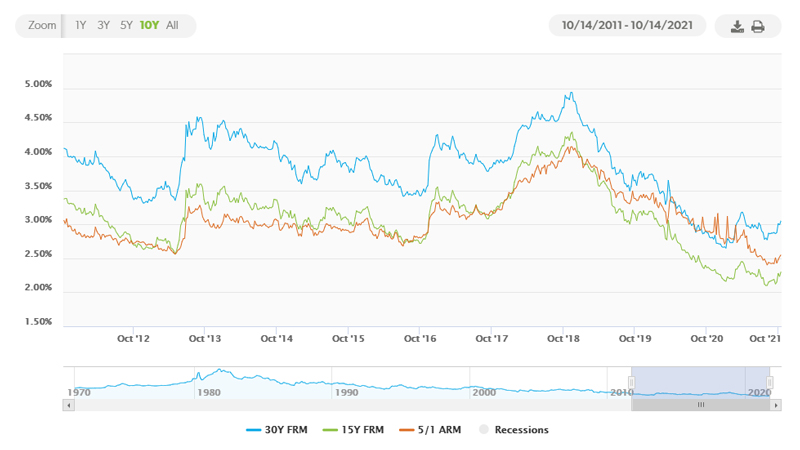

30-year fixed rates have been hovering at or below 3% for over a year now and this has provided some relief for buyers who need financing in a market where affordability has become the real issue. As rates creep above 3% again (like they did last April), some buyers are on the sidelines, not just because of higher rates, but because of the rising cost of purchasing property in South Florida. Lets face it, we need some buyers to sit this out so we can get our inventory levels back to normal and slow down our rising prices in the Fort Lauderdale area real estate market. If you’re a buyer set on purchasing in our market and you believe like us that prices are going to continue to increase for years to come, then you can’t beat our historically low rates. You just need an aggressive real estate agent who can get you in the game when the right property comes available.

BLOG: South Florida’s Real Estate Market Will Remain Strong

Rates Still Historically Low