Condo Inventory is Plentiful, While Median Sale Prices Remain Flat

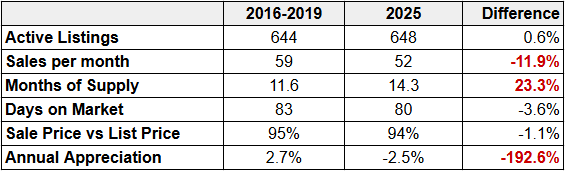

What does a normal oceanfront condominium market look like? For many real estate professionals, the years 2016 through 2019 represent the most balanced and stable period in recent history. This timeframe sits squarely between the lingering effects of the Great Recession and the unprecedented disruption caused by the pandemic, offering the clearest benchmark we have for “normal” market conditions.

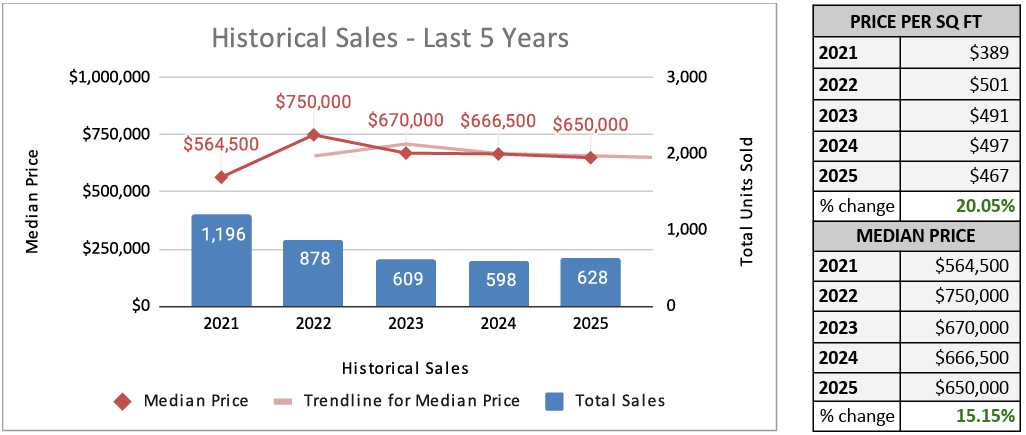

Unlike our single family market, the condominium market experienced additional disruption in June of 2021 when the Champlain Towers condo in Surfside collapsed. This was a huge eye opener for all condo owners, associations and would-be condo buyers. As a result, we now have much stricter regulations regarding condo maintenance and inspections. These new regulations have improved the safety and overall long-term value of our older condo buildings. However, the financial toll has been substantial, with many condo owners absorbing large assessments, with median sale prices relatively flat since 2023.

The Normal Years for Condos: 2016-2019 Compared to 2025

The Good News

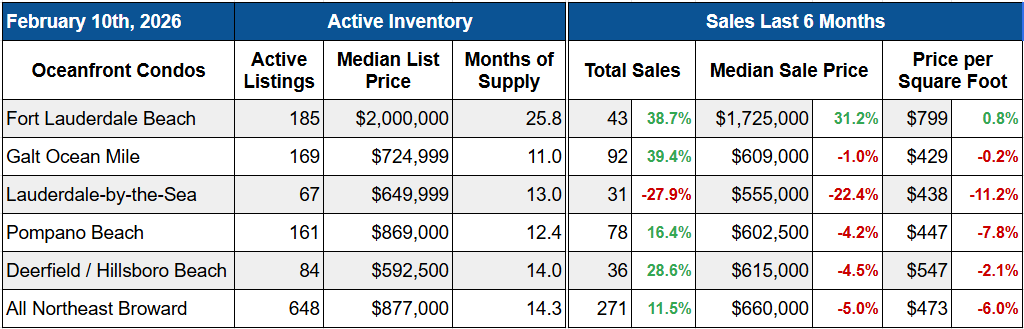

The good news for buyers is that inventory levels have rebounded and median sale prices have been relatively flat since 2023. The oceanfront condo market in NE Broward County currently has 14.3 months of supply, compared to 11.6 months in our benchmark years of 2016-2019. This is probably the best time since the Great Recession to be shopping for a condo.

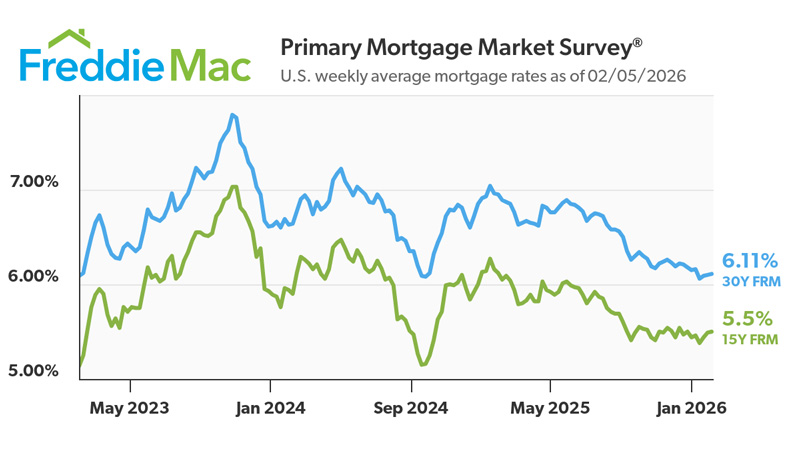

2026 represents a pivotal year for the condominium market. Many oceanfront buildings have already completed their required inspections and structural repairs, with additional properties expected to come into compliance over the next several years. With guidance from experienced local condo experts, buyers are once again gaining confidence in older buildings. Combined with mortgage rates at three-year lows, demand is expected to strengthen throughout 2026. By this time next year, the condo market could be fully recovered and firmly back on a path toward long-term normalcy.

Buyers are once again gaining confidence in older condo buildings. Combined with lower interest rates, demand is expected to strengthen throughout 2026.

All Northeast Broward County Historical Sales of Oceanfront Condos

This is just a report Summary – Download the entire NE Broward Oceanfront Condo Report Here

Local Market Watch – Northeast Broward County Oceanfront Condo Markets

Northeast Broward County has a large number of oceanfront condo buildings located in the communities of Fort Lauderdale, Lauderdale-by-the-Sea, Pompano Beach, Deerfield Beach and Hillsboro Beach.

Fort Lauderdale Beach

Inventory levels of condos in Fort Lauderdale Beach spiked to almost 26 months of supply. This may sound like a lot, but supply tends to fluctuate dramatically in Fort Lauderdale Beach. We expect the inventory to get absorbed just as rapidly this winter season. Sales volume is below normal, but up 38.7% over last year.

Just like the single family market, Fort Lauderdale will likely lead the median sale price recovery. Fort Lauderdale Beach was the only oceanfront market to not lose value from last year. The median sale price over the last 6 months was $1,725,000. Sales price per square foot was also up to $799, a modest 0.8% increase over last year. This is another good sign of a recovering condo market.

Fort Lauderdale Beach is leading the oceanfront condo market recovery – Median sale price and price per square foot were up 31.2% and 0.8% respectively.

This is just a report Summary – Download the entire Fort Lauderdale Beach Condo Report Here

Browse Fort Lauderdale Beach Condo Listings

Galt Ocean Mile

Sales volume in Galt Ocean Mile over the last 6 months picked up dramatically – up 39.4% over last year. Inventory is about average with 11.0 months of supply. The median sale price only dipped 1.0% to $609,000 and price per square foot was only down 0.2% to $429. Buyers are attracted to the walkability of Galt Mile and the lower prices compared to Fort Lauderdale Beach. With the exception of L’Hermitage and L’Ambiance, all the buildings on Galt Mile are over 45 years old, but many of them are now in compliance with new Florida condo laws.

Sales volume in Galt Ocean Mile over the last 6 months picked up dramatically – up 39.4% over last year.

This is just a report Summary – Download the entire Galt Mile Condo Report Here

Browse Galt Ocean Condo Listings

Pompano Beach

The oceanfront condo market in Pompano Beach has performed relatively well in recent years, and is one of our more stable markets, but inventory is a little higher than average at 12.4 months of supply. The median sale price is down 4.2% to $602,500 and price per square foot is also down 7.8% to $447. There is still a good amount of condo renovation work happening in Pompano, which has kept some buyers on the sidelines. As more condo buildings complete their re-certifications we expect prices to go back up.

New construction is booming in Pompano Beach. New projects include The Ritz Carlton, Salato, Ocean 580, Waldorf Astoria and The W Residences.

The oceanfront condo market in Pompano Beach has performed relatively well in recent years, and is one of our more stable markets.

This is just a report Summary – Download the entire Pompano Beach Condo Report Here

Browse Pompano Beach Condo Listings

Lauderdale-by-the-Sea

Lauderdale-by-the-Sea is a smaller condo market compared to Fort Lauderdale and Pompano Beach, so it tends to have more fluctuation in supply and median sale prices. The median sale price of an oceanfront condo in Lauderdale-by-the-Sea over the past 6 months was $555,000. This was down 22.4% from last year, due to the sale of more lower priced units. Price per square foot, on the other hand, was only down 11.2% to $438. Inventory is a bit high at 13.0 months, but it should get absorbed during the busy winter season.

The newest and most popular condos on the beach in Old Town are Villas-by-the-Sea and Oriana. Other popular condos currently undergoing renovations include Hampton Beach Club and Sea Ranch Club.

Condo supply in Lauderdale-by-the-Sea is a bit high at 13.0 months, but we expect good absorption of excess inventory during the busy winter season.

This is just a report Summary – Download the entire Lauderdale-by-the-Sea Condo Report Here

Browse Lauderdale-by-the-Sea Condo Listings

Hillsboro Beach and Deerfield Beach

Inventory in Hillsboro Beach and Deerfield Beach is on the high side at 14.0 months of supply. However, total sales are up 28.6%, a good sign of increased demand heading into the busy season. Median sale price is down 4.5% to $615,000 and price per square foot is down only 2.1% to $547. As another small condo market, Hillsboro Beach / Deerfield Beach tends to have more fluctuations in median sale price and inventory. However, fluctuations are gradual and the market is very stable over time.

With the exception of some newer buildings like Ocean Grande, Orchid Beach and Ocean Plaza, most of the buildings on this stretch were built prior to 1980 and there are plenty of renovations going on. Rosewood Residences is the luxury condo newcomer to Hillsboro Beach.

Condo supply in Hillsboro Beach and Deerfield Beach is a bit high at 14.0 months, but total sales are up 28.6%, a good sign of increased demand heading into the busy season.

This is just a report Summary – Download the entire Hillsboro Beach / Deerfield Beach Condo Report Here

Browse Hillsboro Beach Condo Listings | Browse Deerfield Beach Condo Listings

Summary

The past 5 years have been interesting for the oceanfront condo markets, to say the least. From pandemic shock, to Surfside tragedy, to new condo regulations and massive assessments, its been a wild ride. With the bad comes the good — the current recovery should lead to a normal condo market in the very near future.

As more condo buildings get in compliance with their milestone inspections and reserve studies, we expect the excess inventory to get absorbed in 2026. Combined with lower interest rates and pent-up demand, we expect an increase in the median sale price this year in the 2-3% range, on par with the “normal years” of 2016-2019. Aggressive buyers can expect to find bargains in buildings that are still behind on their regulatory compliance. Sellers with renovated units in financially healthy and compliant buildings can expect to sell for a premium.

Northeast Broward County has a plentiful supply of oceanfront condos. Our barrier island condo markets include Fort Lauderdale Beach, Galt Ocean Mile, Lauderdale-by-the-Sea, Pompano Beach, Hillsboro Beach and Deerfield Beach.

Buying and selling waterfront condos can be tricky business these days. Please make sure you have a local waterfront specialist to assist you.